(Finance) – Piazza Affari bounces like the European stock exchanges, even though it had lost much more ground yesterday due to the government crisis. The prospect of early elections is gaining ground, even if the basic scenario for now remains that of a new Draghi government or the appointment of another transitional prime minister until the end of the legislature. “THE Italian politicians are playing a dangerous game while facing a potential energy crisis, high inflation, a high level of public debt, a slowdown in global demand, a cycle of rising interest rates and significant uncertainties about the ECB’s new “anti-fragmentation” tool “, analysts note Credit Suisse.

Bank of Italyin the latest quarterly economic bulletin, ha revised growth estimates for the country: + 3.2% this year, to then slow down to 1.3% the next and recover slightly to 1.7% in 2024. This is the base scenario, while with the stop to Russian gas there would be a growth lower than 1% this year, followed by a contraction of nearly two percentage points in 2023.

New collapse for Saipemwhich this morning communicated the final data of thecapital increase. Some of the consortium’s 14 banks (Bnp Paribas, Citigroup, Deutsche Bank, Hsbc, UniCredit Abn Amro, Barclays and Stifel) then announced an agreement for a “orderly placement on the market“of approximately 396.4 million shares, equal to 67.8% of the total number of shares not subscribed by investors.

Leap for RCSafter the publishing group e Blackstone they found a deal for close the legal dispute on the purchase of the buildings in via Solferino, the historic headquarters of Corriere della Sera. Consequently, the title also shines Cairo Communication.

The company was admitted to trading on Euronext Growth Milan (EGM) Wells Milan, active in the table fashion sector and owner of the Pozzi and Castello Pozzi brands. The trading start date is set for July 19, 2022.

Brilliant business square, which is in line with the excellent performance of the main European stock exchanges. Meanwhile, Wall Street rides the bullish wave, with theS & P-500 which marks an increase of 1.73%.

Plus sign forEuro / US dollar, which shows an increase of 0.77%. L’Gold the session continues at the levels of the day before, reporting a variation equal to -0.16%. Euphoric session for crude oil, with the Petroleum (Light Sweet Crude Oil) which shows a jump of 2.55%.

Consolidate the levels of the eve it spreadsettling at +217 basis points, with the yield of Ten-year BTP which is positioned at 3.24%.

Among the markets of the Old Continent incandescent Frankfurtwhich boasts a strong increase of 2.76%, in the foreground Londonwhich shows a strong increase of 1.69%, and takes off Pariswith a significant increase of 2.04%.

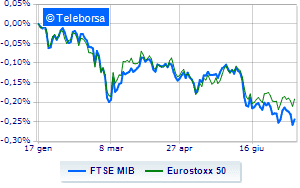

TO Milanclosed with a sharp rise on FTSE MIB (+ 1.84%), which reaches 20,933 points, interrupting the series of four consecutive declines, which began last Monday; on the same line, brilliant day for the FTSE Italia All-Share, which ends at 22,956 points. The FTSE Italia Mid Cap (+ 1.66%); with the same direction, the FTSE Italia Star (+ 1.9%).

From the closing data of the Italian Stock Exchange, it appears that the countervalue trading in today’s session amounted to € 1.58 billion, down by 27.48%, compared to € 2.17 billion on the eve; while the volumes traded went from 0.7 billion shares of the previous session to today’s 0.6 billion.

Among the best Blue Chips of Piazza Affari, in evidence Interpumpwhich shows a strong increase of 5.60%.

It stands out Pirelli which marks an important progress of 5.57%.

Fly Ivecowith a marked increase of 5.56%.

It shines Is in thewith a strong increase (+ 3.41%).

The strongest declines, on the other hand, occurred on Saipemwhich closed the session at -29.91%.

Black session for Telecom Italiawhich leaves a 3.42% loss on the table.

Decline for Campariwhich marks a -1.07%.

Among the protagonists of the FTSE MidCap, Mutuionline (+ 5.79%), Antares Vision (+ 5.13%), Anima Holding (+ 4.78%) e doValue (+ 4.06%).

The strongest declines, on the other hand, occurred on MPS Bankwhich closed the session at -6.18%.

At a loss Mfe Bwhich falls by 2.78%.

Heavy Mfe Awhich marks a drop of as much as -2.52 percentage points.

Negative sitting for Wiitwhich falls by 2.30%.