Since January 1, the new Pinel + system has allowed individuals who invest in new builds to benefit from tax reductions. These amount to 12%, 18% or 21% of the price of the accommodation (up to a limit of 5,500 euros per square meter and 300,000 euros), depending on whether the property is rented for six, nine or twelve years respectively. At the same time, the old Pinel formula remains in force, but it shows a reduced tax advantage, at 10.5%, 15% or 17.5% respectively this year; 9%, 12% and 14% next year.

If the tax benefit differs, the two formulas meet the same conditions. “In addition to the rental commitment for a specific period, the same rent ceilings apply depending on the geographical area and the size of the household, specifies Estelle Billi, heritage engineer at Advenis Gestion Privée. Tenants must also respect conditions of resources identical.” In addition, in both cases, the tax reduction obtained enters the cap on tax loopholes of 10,000 euros per year.

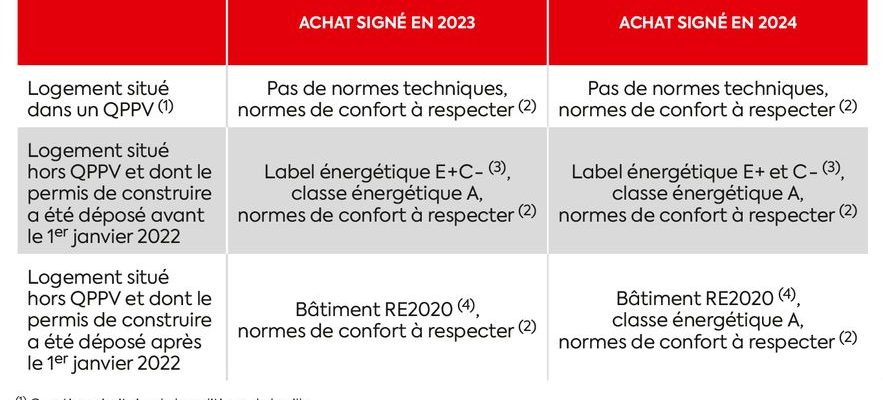

The difference ? For a new building to be eligible for Pinel +, it must be built with more virtuous environmental standards. “Only programs located in a priority district of city policy (QPPV) escape this requirement”, specifies Franck Vignaud, director of the Laboratory of real estate, specializing in new real estate. In addition, accommodation rented in Pinel + must comply with certain comfort standards, in particular a minimum size (28 m² for a studio, 45 m² for a two-room apartment and 62 m² for a three-room apartment) and an exterior. “Each accommodation must have a garden or a balcony, for example 3 m² minimum for a studio or two-room apartment and 5 m² minimum for a three-room apartment”, continues Franck Vignaud. Finally, from the three-room apartment, the apartments must benefit from at least two different orientations.

© / The Express

A new sector in crisis

Because of these many additional constraints, an operation in Pinel + will not necessarily be more profitable than an investment in Pinel, despite greater tax savings. Indeed, “as Pinel + housing is subject to minimum surface requirements, they will be larger than in Pinel”, notes Franck Vignaud. As a result, you will have to spend more to become an owner. If you are targeting a location where prices are high, it is not clear that this additional purchase cost will be offset by your additional tax gain, especially since, in these areas, selling prices almost always exceed reduction ceilings, which reduces the tax advantage.

The only hope of making your operation profitable then rests on resale. The Pinel + being subject to more demanding construction standards, it is likely that it will be better valued at the end of the operation. However, we should not hope to reap strong capital gains in the coming years because the real estate market is currently on a downward trend. It is therefore better to carry out extensive financial simulations before you decide.

Last pitfall: it is currently difficult to find a building that meets the Pinel + conditions. Indeed, the new construction sector is going through a crisis and few developers have launched programs that meet the new standards. A lot of Pinel+ on sale today are actually “recycled” Pinels that didn’t sell in the QPPV zone. Nothing very attractive in general. However, when you buy a home to rent it, do not lose sight of the main criterion for your operation to be profitable: invest in a city where rental demand is strong and solvent.