To have additional income in retirement or build up a heritage, many individuals dream of investing in stone. But apartment prices in metropolitan areas, where rental demand is strong, remain high. A solution exists to buy cheaper: the free life annuity.

With this type of operation, the seller – called the annuitant – sells real estate by agreeing to no longer occupy it. For the investor, the advantage is therefore immediate, unlike an occupied life annuity: he can settle down or rent the accommodation, his only constraint being the impossibility of selling it before the death of the annuitant.

Taxes not to be overlooked

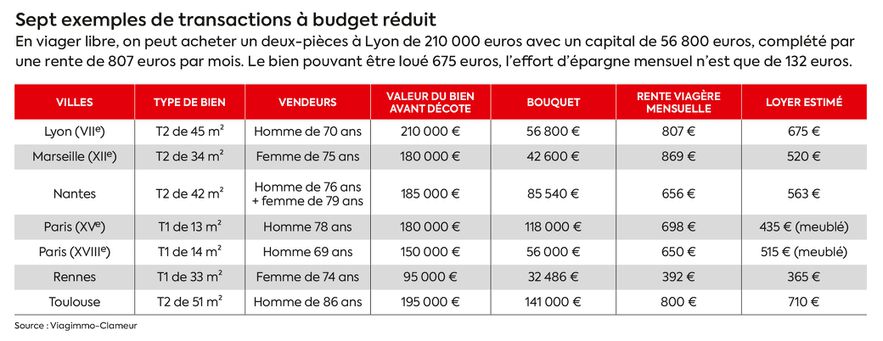

In life annuity, the value of the housing is determined in a traditional way according to the market, then “a discount is applied, according to whether the life annuity is free or occupied, the seller more or less old and the fact that the annuity is paid to a person or a couple”, says Olivier Garel-Galais, notary in Lyon and member of the Monassier Group. Note that the discount in free life is lower than in the case of an occupied life. From this discounted price, the owner sets the amount of capital he wishes to receive immediately upon signing the contract. In general, this “bouquet” oscillates between 25 and 40% of the total, but there is no rule in the matter. The balance is converted into an annuity. “In life free as occupied, it is paid to the annuitant until his disappearance”, specifies Sophie Richard, founder of the specialized network Viagimmo. The larger the bouquet, the smaller the rent, and vice versa. Moreover, the latter depending on the life expectancy of the seller, it will be higher the older he is at the time of the sale.

If you buy free life, it may be that the accommodation is already rented, it will then be necessary to continue the lease with the tenant in place. “Before you commit, check that he pays his rent regularly,” advises Sophie Richard. If the accommodation is free, you can install a tenant there without the approval of your seller. In both cases, you are the one who collects the rents. Be careful, “jurisprudence indicates that they must remain lower than the pension”, warns Sophie Richard.

© / The Express

Throughout the duration of the life annuity, you support the work (restoration of the property, repairs, etc.), pay the property tax, the non-recoverable charges on the tenant and the insurance of the property. You must also assume the property tax on the rents collected and the property wealth tax if you are concerned.

Finally, be aware that banks almost never finance life annuity operations on credit, so you must have capital to pay for the package, but also sufficient cash to deal with a risk (rental vacancy, work, etc.) and to different loads. In addition, your income must be sufficient to pay each month the difference between the rent collected and the annuity. Because if you find yourself unable to pay it, the seller could recover full ownership of his property in court, without necessarily having to reimburse you for the sums paid beforehand. Finally, keep in mind that overpaying for housing is possible if your seller breaks longevity records.