(Finance) – Wall Street crosses the mid-session finish line with positive indices, with investors fearing that the Fed may launch a further monetary tightening to contain inflation. The Chairman of the Federal Reserve, Jerome Powell, He stressed that he is not sure that the US central bank’s position is sufficient to bring inflation back to the 2% target. In the wake of his statements, American stock prices yesterday interrupted their longest positive streak in the last two years with caution prevailing over operator sentiment.

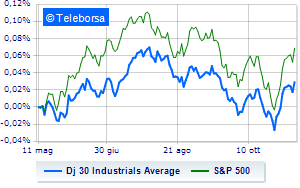

Among US indices, the Dow Jones advances to 34,160 points; along the same lines, positive performance for theS&P-500, which continues the day with an increase of 1.08% compared to the close of the previous session. Rev up the Nasdaq 100 (+1.74%); on the same line, theS&P 100 (+1.19%).

The sectors highlighted on the North American S&P500 list informatics (+2.09%), telecommunications (+1.23%) e secondary consumer goods (+1.01%).

Among the best Blue Chips of the Dow Jones, Intel (+2.46%), Microsoft (+1.89%), Dow (+1.75%) e Apple (+1.53%).

The strongest sales, however, occur at Walt Disneywhich continues trading at -3.34%.

He hesitates Merckwith a modest decline of 1.46%.

Slow day for Nikewhich marks a decline of 1.12%.

Small loss for Johnson & Johnsonwhich trades at -1.05%.

To the top between Wall Street tech giantsthey position themselves Advanced Micro Devices (+4.56%), KLA-Tencor (+4.26%), LamResearch (+3.98%) e Applied Materials (+3.90%).

The strongest sales, however, occur at Trade Deskwhich continues trading at -17.94%.

Thud of Illuminatewhich shows a fall of 13.45%.

He suffers Polishedwhich highlights a loss of 2.66%.

Prey for sellers Astrazenecawith a decrease of 2.31%.