MACRON BONUS 2022. The amount of the exceptional purchasing power bonus will reach 6,000 euros this year. What date ? For who ? All the information in our dedicated article.

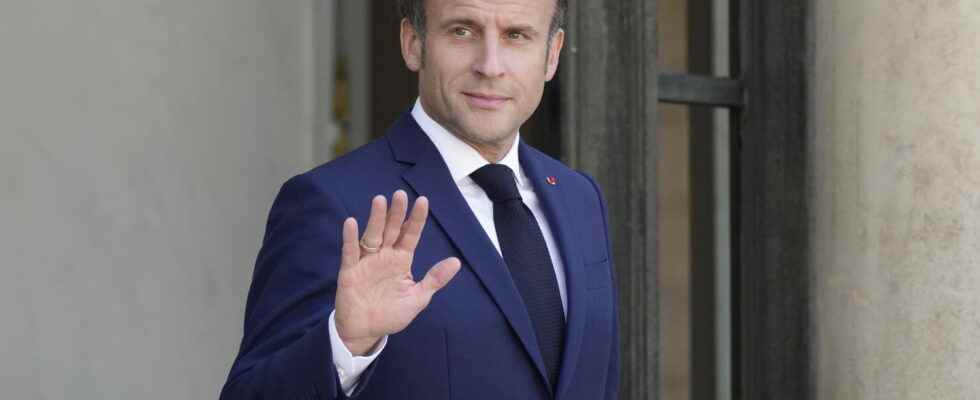

[Mis à jour le 30 mai 2022 à 08h07] The deadline is approaching. The amount of the Macron bonus will increase, and significantly! Ella will triple in 2022, in all likelihood following the legislative elections in the event of a majority obtained by the camp TheREM. The announcement should therefore be made in the coming weeks, when the purchasing power bill comes into force bringing together several measures aimed at lightening the wallets of the French, such as the indexation of pensions on inflation. or the extension of the fuel discount. The Macron bonus was one of the strong points of Emmanuel Macron’s presidential campaign and could allow many employers to pay this famous “employee dividend“to the employees who invest themselves every day, for the last two complicated years marked by the successive crises of Covid-19 and the war in Ukraine.

The amount of the PEPA bonus will increase from 1,000 euros to 3,000 euros and from 2,000 euros to a maximum of 6,000 euros for companies that have signed aprofit-sharing, or companies with less than 50 employees. Employees precisely, how can they claim this exceptional bonus? All employees whose salary is less than 3 times the Smic apply! It’s that simple. And employers in all this? The payment of the PEPA premium is totally voluntary, there is no obligation for them. This premium remains totally tax-exempt, whether on the side of the boss or the employee. It is therefore not to be included on his tax return, the deadline of which is fast approaching for millions of taxpayers. Improvements to its implementation could also be decided by the Head of State. Last year, 4 million people took advantage of it for an average amount paid of 506 euros, below expectations.

Since 2019, employees have been able to receive an exceptional bonus, exempt from taxes and social security contributions called “Macron bonus”. This exceptional purchasing power bonus (is paid by any employer who wishes it to employees, under certain conditions. In particular if the employee in question does not exceed a certain income limit. This tax and social security exemption scheme aims to encourage employers to pay bonuses to their employees in order to enhance their purchasing power. It is not a state bonus, but a company bonus which remains optional and voluntary.

To be exempt from employee contributions, the Macron bonus cannot exceed the amount of €1,000. Companies that have a profit-sharing agreement can pay the Macron bonus up to €2,000. This amount, doubled, is also valid for companies with fewer than 50 employees, and second-line workers (if revaluation measures are taken). This bonus could now triple in the event of re-election of the LREM candidate on April 24, going from 1,000 euros to 3,000 euros. And up to 6,000 euros without charges or taxes for companies benefiting from a profit-sharing agreement.

The exceptional purchasing power bonus is exempt from income tax and from any social security contributions or contributions. But then, who is eligible for the Macron bonus? Employees earning less than 3 times the Smic (over the 12 months preceding the payment). This Macron bonus does not replace any element of remuneration. Already extended in 2021, the premium PEPA is renewed for the year 2022. Note that the employer is not obliged to pay the Macron bonus. If he wishes to pay it, he has the option of doing so atall of its employeesor only to employees whose remuneration is less than 3 times the Smic.

In 2022, the Macron bonus benefits both employees and apprentices, as well as temporary workers and public officials. The employer can completely modulate the amount of the payment of the PEPA bonus according to the beneficiary according to certain criteria such as the employee’s remuneration, the employee’s classification level, his working conditions during the Covid crisis, or still his working time over a year.

The Macron bonus is paid within a period provided for by law. In this case, between the June 1, 2021 and the March 31, 2022. Whether you are a civil servant, an employee, or an industrialist, you have the possibility of benefiting from it. With the purchasing power bill, the reform of the Macron bonus should be announced in the coming weeks, after the legislative elections according to the last words of government spokesperson Olivia Grégoire.

The amount of the Macron bonus exempt from contributions is capped at €1,000. However, this amount may double and reach €2,000 in the following cases:

- The company has signed a profit-sharing agreement

- The company has less than 50 employees

- Second-line workers (if upgrading measures are taken)