(Finance) – The Wall Street indices turned positive in the middle of the session, after a difficult opening. Investors found themselves in digest labor market data much better than expected and the first reaction of the market was negative: according to several observers, the numbers they will encourage the Federal Reserve to raise interest rates by half a percentage point at the March meeting, more than the 25 basis points priced so far.

On the front of the quarterly, they shine Amazon, with quarterly profit nearly doubled, e Snap, which reported double earnings per share compared to the consensus. They collapse Ford, which posted a below-expected profit in the final quarter of 2021, e Clorox, due to disappointing guidance due to rising commodity prices, transportation costs and supply chain problems

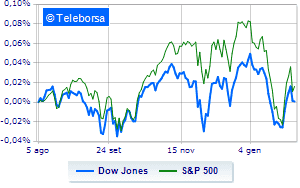

Stop around parity on Dow Jones, which stood at 35,147 points, while theS & P-500, which brings to 4,509 points. In upside the Nasdaq 100 (+ 1.43%); as well, theS&P 100 (+ 1.02%). Featured on the North American S&P 500 i price list compartments secondary consumer goods (+ 4.05%), power (+ 1.81%) e financial (+ 1.65%). In the list, the sectors materials (-1.22%), industrial goods (-0.87%) e consumer goods for the office (-0.73%) are among the best sellers.

To the top between giants of Wall Street, Salesforce.Com (+ 3.35%), Microsoft (+ 2.01%), Goldman Sachs (+ 2.01%) e American Express (+ 1.59%).

The worst performances, on the other hand, are recorded on 3M, which gets -2.23%.

Decline for Walgreens Boots Alliance, which marks a -1.76%.

Under pressure Visa, with a sharp decline of 1.62%.

Suffers Caterpillar, which shows a loss of 1.51%.

On the podium of the Nasdaq titles, Amazon (+ 14.84%), Ebay (+ 4.16%), Tesla Motors (+ 3.75%) e Autodesk (+ 2.37%).

The strongest sales, on the other hand, show up on Garmin, which continues trading at -6.00%.

Bad performance for Texas Instruments, which recorded a decline of 2.92%.

Prey of the sellers Stericycle, with a decrease of 1.83%.

Sales focus on Gilead Sciences, which suffers a decline of 1.77%.