(Finance) – Departure in cautious rise for the Wall Street stock exchange while The expectation is growing for the American result of the mid-term elections which will be held tomorrow 8 November. According to various polls, the vote could give the United States a divided or Republican majority Congress that could win the ballot box.

Investors’ attention also remains focused on Federal Reserve and on its “hawkish” attitude also expected in the coming months, in the light of an American job market that has proved to be thriving. At this point the focus shifts to the important given that will arrive in the week, that is oninflation to the stars and stripes which will be released on Thursday.

On the corporate front, they are under pressure from the technologists with thousands of layoffs in sight in companies in the sector.

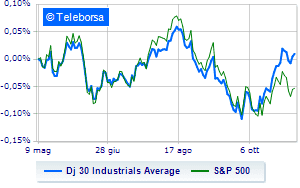

Among the US indices, the Dow Jones shows an increase of 0.37%, while theS & P-500 salt by 0.29% and the Nasdaq 100 timidly advances by 0.12%; above parity also theS&P 100 (+ 0.40%).

Between the data relevant macroeconomics on US markets:

Wednesday 09/11/2022

4:00 pm USA: Wholesale stocks, monthly (formerly 1.3%)

16:30 USA: Oil stocks, weekly (previous -3.12 Mln barrels)

Thursday 10/11/2022

14:30 USA: Consumption prices, annual (8% expected; previous 8.2%)

14:30 USA: Consumption prices, monthly (expected 0.7%; previous 0.4%)

14:30 USA: Unemployment Claims, Weekly (Previous 217K Units).