(Finance) – Wall Street continues the session up, with the eyes of investors focused on the Federal Reserve now convinced that it will raise interest rates, by 75 basis points for the third consecutive time, at the next meeting on the agenda on 20-21 September.

On the corporate front, focus on the stock Apple on the day of presentation of its new products. Also in evidence Twitter after a Delaware judge rejected Tesla boss Elon Musk’s request to postpone the start of the trial that sees him opposed to Twitter, set for October 17, to November. Tesla’s chief executive, however, has been able to add to his counter-cause the testimony of an “informant” who recently accused the social platform of hiding and ignoring the presence of serious vulnerabilities to its protection system.

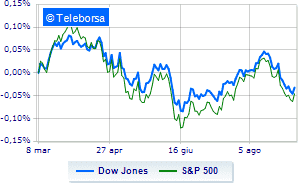

Among the US indices, the Dow Jones advances to 31,434 points; on the same line, day of earnings for theS & P-500, which continues the day at 3,953 points. In money the Nasdaq 100 (+ 1.28%); as well, the performance of theS&P 100 (+ 0.97%).

The sectors are in good evidence in the S&P 500 utilities (+ 2.55%), secondary consumer goods (+ 1.89%) e materials (+ 1.71%). The sector powerwith its -1.49%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, 3M (+ 3.01%), Walgreens Boots Alliance (+ 1.95%), Wal-Mart (+ 1.85%) e Nike (+ 1.70%).

The strongest falls, on the other hand, occur on Chevronwhich continues the session with -1.65%.

On the podium of the Nasdaq titles, Dexcom (+ 5.61%), Match (+ 5.09%), Ross Stores (+ 5.06%) e Intuit (+ 3.54%).

The strongest falls, on the other hand, occur on Old Dominion Freight Linewhich continues the session with -2.15%.

Suffers Astrazenecawhich shows a loss of 1.35%.

Lazy Crowdstrike Holdingswhich shows a small decrease of 0.70%.

Between the data relevant macroeconomics on US markets:

Wednesday 07/09/2022

14:30 USA: Balance of trade (expected -70.3 B $; previously -80.9 B $)

Thursday 08/09/2022

14:30 USA: Unemployment Claims, Weekly (Expected 240K Units; Previously 232K Units)

17:00 USA: Oil stocks, weekly (previous -3.33 Mln barrels)

Friday 09/09/2022

4:00 pm USA: Wholesale stocks, monthly (expected 0.8%; previous 1.8%)

Tuesday 13/09/2022

14:30 USA: Consumption prices, monthly (previous 0%).