(Finance) – Positive sitting on Wall Streetafter i producer prices for the month of July they were lower than expected, one day after the moderation in consumer prices. The hope of investors is that the price rush for companies and consumers has reached a peak and that the macroeconomic data of these days can change theaggressive stance of the American central bank. Still on the macroeconomic front, they increased slightly and in line with expectations claims for unemployment benefit In the USA.

Between quarterly released between yesterday and this morning, the positive performance of Walt Disney. The entertainment giant – active in theme parks and for some years also in streaming – has announced a total of 221 million streaming clientssurpassing for the first time those of Netflix.

Instead they have disappointed Are S (audio equipment manufacturer), which cut its guidance due to the difficult macroeconomic environment, Bumble (online dating company), which revised its outlook downward citing inflation and foreign exchange headwinds, Six Flags (the theme park company), with the decline in attendance making itself felt on quarterly profits and revenues.

Meanwhile, OPEC he cut his forecasts on the growth in world oil demand in 2022. After a better-than-expected first half, the impact of the Russian invasion of Ukraine, high inflation and efforts to contain the coronavirus pandemic will be felt in the second half of the year.

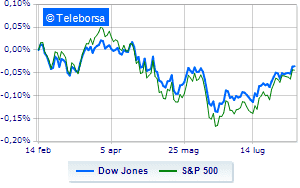

Wall Street continues the session with a fractional gain on the Dow Jones 0.56%; on the same line, theS & P-500 proceeds in small steps, advancing to 4,231 points. Consolidate eve levels on Nasdaq 100 (+ 0.07%); slightly positiveS&P 100 (+ 0.33%). In good evidence in the S&P 500 i compartments power (+ 3.33%), financial (+ 1.21%) e materials (+ 1.17%).

Between protagonists of the Dow Jones, Walt Disney (+ 5.82%), Chevron (+ 2.91%), DOW (+ 2.64%) e Travelers Company (+ 2.47%).

The worst performances, on the other hand, are recorded on Johnson & Johnsonwhich gets -1.37%.

Between protagonists of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 5.45%), AirBnb (+ 3.43%), JD.com (+ 3.21%) e Constellation Energy (+ 3.09%).

The worst performances, on the other hand, are recorded on Splunkwhich gets -3.10%.

At a loss Atlassianwhich falls by 3.09%.

Heavy Docusignwhich marks a drop of -3.02 percentage points.

Negative sitting for Zoom Video Communicationswhich falls by 2.72%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 11/08/2022

14:30 USA: Unemployment Claims, Weekly (Expected 263K Units; Previous 248K Units)

14:30 USA: Production prices, annual (expected 10.4%; previous 11.3%)

14:30 USA: Production prices, monthly (expected 0.2%; previous 1%)

Friday 12/08/2022

14:30 USA: Import prices, monthly (expected -1%; previous 0.2%)

14:30 USA: Export prices, monthly (expected -0.4%; previous 0.7%).