(Finance) – Le Japanese stocks are back towards a 33-year highdoing better than most other Asian markets, thanks to the rally of chip companies (Advantest +4.3%, Tokyo Electron +4.4%, Dainippon Screen +5.8%), in the wake of results above expectations and the leap on Wall Street of the giant Nvidia. The Japanese list also benefited from aweaker-than-expected inflation for Tokyowhich could herald more weakness in domestic inflation and keep the Bank of Japan dovish.

They stay behind the Chinese marketswith investors worried about the slowdown in economic growth and worsening relations with the United States. Rising COVID-19 cases are also holding back investors, with a new outbreak set to peak by the end of June.

On the currency front, sources told Reuters that the Chinese state banks they have been seen sell dollars in the spot market from Thursday to Friday, to slow the pace of the yuan’s decline.

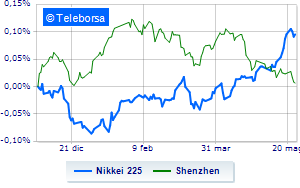

Tokyo shows a gain, with the Nikkei 225 which is achieving +0.47%, while, on the contrary, it remains at the starting line Shenzhen (+0.1%), which is positioned close to the previous levels. Shanghai salt by 0.33%.

In fractional progress Seoul (+0.22%). Fractional earnings for mumbai (+0.5%); with the same direction, just above parity Sydney (+0.21%).

The stock market of Hong Kong And closed for Buddha’s birthday.

Substantially flattened on the values prior to the session of theEuro against the Japanese currency, which is making a moderate -0.18%. unhappy performance forEuro against the Chinese currency, which presents a negative percentage change of 0.23% compared to the previous session. Sitting neglected forEuro against the Hong Kong dollarwhich shows a timid +0.07%.

The yield for theJapanese 10-year bond is equal to 0.42%, while the yield of Chinese 10-year government bond treats 2.72%.