(Finance) – Wall Street is moving higherwith investors continuing to consider whether i signs of a cooling of inflation (with data on consumer prices and producer prices released in recent days) will allow the Federal Reserve to move towards less aggressive interest rate increases. “Before the September FOMC we will see another set of payroll and CPI data and, at the moment, the odds of a 50 to 75 basis point hike look pretty balanced,” commented Mark Dowding, CIO. by BlueBay.

Goldman Sachs claimed that the US economy “is going through a healthy deceleration, not a recession“, while Bank of America noted that the investors are returning to buy stocks and bonds, with global equity funds raising $ 7.1 billion in the week through August 10.

On the macroeconomic front, they fell beyond expectations i import-export prices USA in July 2022, according to the American Bureau of Labor Statistics. Investors also find themselves evaluating the preliminary data for August relating to the consumer confidence calculated by the University of Michigan.

Among those who disseminated the quarterly between last night and this morning, Rivian reported that the net loss for the second quarter of 2022 was $ 1,712 million, while it continues to increase production. Illuminate revised 2022 guidance downwards after a disappointing quarterly report.

Five of the largest Chinese state-owned companiesin a move not explicitly coordinated but implemented simultaneously, they announced their intention to withdraw their shares from US stock exchanges.

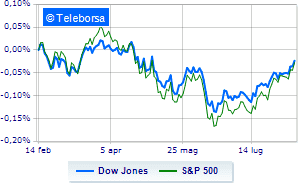

Slightly up for Wall Streetwith the Dow Jones, which advanced to 33,477 points, continuing the bullish trail highlighted by three consecutive gains, triggered last Wednesday; on the same line, slight increase forS & P-500, which brings to 4,227 points. In fractional progress the Nasdaq 100 (+ 0.49%); on the same trend, just above parity theS&P 100 (+ 0.5%).

Featured on the North American S&P 500 i price list compartments telecommunications (+ 0.90%), utilities (+ 0.70%) e sanitary (+ 0.62%). The sector powerwith its -0.79%, it is the worst of the market.

To the top between giants of Wall Street, Walt Disney (+ 2.21%), Merck (+ 1.14%), Intel (+ 0.97%) e United Health (+ 0.92%).

The strongest falls, on the other hand, occur on Chevronwhich continues the session with -0.75%.

Between best performers of the Nasdaq 100, Workday (+ 3.17%), Match (+ 1.86%), Palo Alto Networks (+ 1.78%) e Constellation Energy (+ 1.74%).

The strongest falls, on the other hand, occur on Illuminatewhich continues the session with -9.28%.

Negative sitting for Pinduoduo Inc Spon Each Repwhich shows a loss of 1.98%.

Under pressure JD.comwhich shows a decrease of 1.74%.

It slips Baiduwith a clear disadvantage of 1.10%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 12/08/2022

14:30 USA: Import prices, monthly (expected -1%; previous 0.3%)

14:30 USA: Export prices, monthly (expected -1.1%; previous 0.7%)

4:00 pm USA: University of Michigan Consumer Confidence (expected 52.5 points; preceded 51.5 points)

Monday 15/08/2022

14:30 USA: Empire State Index (preceding 11.1 points)

Tuesday 16/08/2022

14:30 USA: Building permits (previous 1.69 million units).