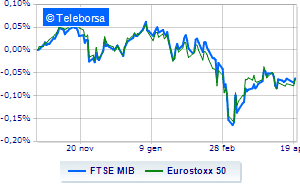

(Finance) – Positive day for European stock exchangeson a day marked by quarterly reports of large multinationals (the positive performances of ASMLwith a demand higher than the current production capacity, e Danone, with price increases absorbing cost increases). Concerns remain in the background over rising yields and developments in the war in Ukraine. Good positive also for Piazza Affari, after yesterday had been ballasted by the coupon detachment of eight FTSE MIB companies. At the sector level, poor performance of the sector do you travelon which the discounts of Autogrill after yesterday’s leap following rumors about a possible aggregation with the Swiss rival Dufry. The sector is doing well tech, food and banks. On the FTSE MIB they stand out Banco BPM (with a report of Mediobanca which speaks of a “takeover in the near future”) e BPER.

Slight growth ofEuro / US dollar, which rises to an altitude of 1.085. Substantially stable thegold, which continues the session on the eve of the levels at 1,950.9 dollars an ounce. Sitting on parity for oil (Light Sweet Crude Oil), which stands at 102.5 dollars per barrel.

Unchanged it spreadwhich is positioned at +165 basis points, with the yield of the ten-year BTP standing at 2.51%.

Among the European lists moves into positive territory Frankfurtshowing an increase of 1.47%, small step forward for Londonwhich shows a progress of 0.37%, and money on Pariswhich recorded an increase of 1.38%.

Piazza Affari closed the session up, with the FTSE MIB which advances to 24,878 points, while, on the contrary, the FTSE Italia All-Share it lost 0.86%, ending the session at 26,890 points.

Salt the FTSE Italia Mid Cap (+ 1%); with the same direction, in fractional progress the FTSE Italia Star (+ 0.51%).

At the close of the Milan Stock Exchange, the turnover in today’s session was equal to 2.27 billion euros, a significant decrease (-17.2%), compared to the previous session which had seen the trading of 2.74 billion euros; while the volumes traded went from 0.54 billion shares of the previous session to today’s 0.55 billion.

Among the best Blue Chips of Piazza Affari, takes off Banco BPMwith an important progress of 4.46%.

In evidence BPERwhich shows a strong increase of 3.52%.

It stands out Pirelli which marks an important increase of 3.28%.

Fly STMicroelectronicswith a marked increase of 3.24%.

The strongest declines, on the other hand, occurred on DiaSorinwhich closed the session at -1.53%.

Suffers Amplifonwhich shows a loss of 1.52%.

Prey of the sellers Telecom Italiawith a decrease of 1.21%.

Undertone Terna which shows a filing of 0.64%.

Among the protagonists of the FTSE MidCap, Intercos (+ 7.48%), Credem (+ 4.48%), Cementir Holding (+ 3.68%) e Danieli (+ 3.65%).

Stronger sales, on the other hand, fell on Autogrillwhich ended trading at -4.78%.

Sales focus on OVSwhich suffers a decline of 1.76%.

Sales on Wiitwhich recorded a decline of 1.52%.

Negative sitting for BFwhich shows a loss of 1.38%.

Between macroeconomic variables heavier:

Wednesday 20/04/2022

01:50 Japan: Balance of trade (expected ¥ 100.8bn; previous ¥ -668.3bn)

06:30 Japan: Services index, monthly (previous -0.2%)

08:00 Germany: Production prices, annual (expected 28.2%; previous 25.9%)

08:00 Germany: Production prices, monthly (expected 2.6%; previous 1.4%)

11:00 am European Union: Industrial production, annual (expected 1.5%; previous -1.5%).