(Finance) – Positive closing for Piazza Affari, even if below the highs of the day, like the other European exchanges. It may have been the recent oversold and not improved investor sentiment. Indications are also awaited from the meeting of European Union leaders on 23-24 June, from which they could exit new sanctionswith gold among the assets likely to be affected by a new round of measures to continue responding to Moscow’s aggression against Ukraine.

The positive performance of the FTSE MIB stands out Leonardo (which, however, closes far from the highs of the day), after the agreement for to merge the American subsidiary DRS with the Israeli Radalisted in New York and Tel Aviv.

On the negative performance of Terna, Italgas And Snam weighs the review of the opinion and cut of target prices from Citigroup. The trend in utilities, on the other hand, is affected by possible actions by the Government in the event of an emergency on gas supplies, including the possible reduction in consumption for energy-intensive companies, according to press rumors. “The interruption / reduction of consumption is a negative element for all retailers (Is in the, Eni, A2A, Iren, Hera, Acea) in terms of lost revenues for the shares corresponding to lower consumption and interruptions “, write the analysts of Equity.

L’Euro / US dollar shows a timid gain, with a progress of 0.42%. L’Gold the session continues at the levels of the day before, reporting a variation equal to -0.11%. Good upside for the Petroleum (Light Sweet Crude Oil), which posted a gain of 0.48%.

Consolidate the levels of the eve it spreadsettling at +192 basis points, with the yield of the ten-year BTP which is positioned at 3.68%.

Among the main European stock exchanges moderate earnings for Frankfurtwhich advances by 0.20%, small steps forward for Londonwhich marks a marginal increase of 0.42%, e Paris advances by 0.75%.

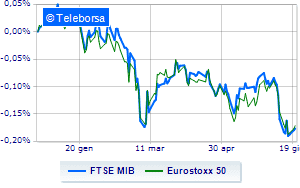

The Milanese price list shows a timid gain in closing, with the FTSE MIB which scored + 0.39%, continuing the streak that began last Friday; on the same line, the FTSE Italia All-Share, which increases compared to the day before reaching 24,043 points. Just above parity the FTSE Italia Mid Cap (+ 0.21%); on the same trend, fractional earnings for the FTSE Italia Star (+ 0.67%).

At the close of the Milan Stock Exchange, the countervalue trading in today’s session was equal to 1.42 billion euro, a marked decrease (-57.16%), compared to the previous session which had seen the negotiation of 3.31 billion euro; while the volumes traded went from 0.8 billion shares of the previous session to today’s 0.42 billion.

At the top of the ranking of the most important titles of Milan, we find Leonardo (+ 3.51%), STMicroelectronics (+ 2.57%), Stellantis (+ 2.50%) e Banco BPM (+ 2.08%).

Stronger sales, on the other hand, fell on Recordatiwhich ended trading at -3.40%.

Black session for Italgaswhich leaves a 3.00% loss on the table.

Decline for A2Awhich marks a -2.33%.

Under pressure Generali Insurancewith a sharp decline of 1.35%.

Among the protagonists of the FTSE MidCap, Safilo (+ 2.66%), Fincantieri (+ 2.19%), Reply (+ 2.16%) e Webuild (+ 2.09%).

The worst performances, however, were recorded on BFwhich closed at -4.30%.

At a loss Mfe Awhich falls by 4.03%.

Heavy Wiitwhich marks a drop of as much as -2.28 percentage points.

Negative sitting for Ariston Holdingwhich falls by 2.26%.

Between the data relevant macroeconomics:

Tuesday 21/06/2022

4:00 pm USA: Sale of existing homes, monthly (previous -2.6%)

Wednesday 22/06/2022

08:00 United Kingdom: Production prices, annual (previous 14%)

08:00 United Kingdom: Consumption prices, monthly (expected 0.6%; previous 2.5%)

08:00 United Kingdom: Consumption prices, yearly (9.1% expected; 9% before)

08:00 United Kingdom: Production prices, monthly (previous 2.3%).