(Finance) – Last session of the week, before the long weekend of August, positive for Piazza Affari. In the afternoon, all the European stock exchanges accelerate upwards, also thanks to the rally on Wall Street. News flow in Europe has been relatively quiet even today, as high summer temperatures and drought aggravate the energy crisis. There gas price pressure did not stop and the futures contracts for TTF gas (used by operators as a benchmark for the European market) remained above 200 euros / MWh.

However, the calm of the mid-August session should not make operators think that the hardest period of the year on the markets is now behind us. “We believe that if we were to witness a couple of weeks of calm in mid-summer, we should use this opportunity for positioning portfolios in anticipation of a return to more volatile conditions when everyone is back from vacation in early September, “said Mark Dowding, CIO of BlueBay.

To drive the FTSE MIB are the rises of TIM, Nexi And Banco BPMwith the titles of the three companies that were affected by press rumors. Telecom Italia was taken after a Bloomberg indiscretion that Fratelli d’Italia is allegedly working on a plan to delist the former monopolist telecommunications and sell the various assets to reduce the debt burdening the group by more than half.

Nexi benefits from betting on possible extraordinary transactionsafter Reuters wrote that earlier this year it received several unsolicited approaches from companies private equity, including Silver Lake, who wished to acquire it. The discussions failed due to price differences, according to sources heard by the agency.

Banco BPM benefited from speculation about the role of JPMorgan in its capital and of potential links with the choices of Credit Agricole.

Sitting without jolts for Exor, which today has also started trading on the Amsterdam Stock Exchange. Borsa Italiana has ordered the delisting of the Exor ordinary shares from Euronext Milan with effect from 27 September 2022.

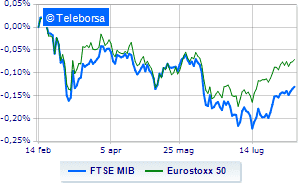

Slight increase for Piazza Affari, like the main European Stock Exchanges. Meanwhile, the New York Stock Exchange continues to gain ground, with theS & P-500 which advances by 0.87%.

Weak session forEuro / US dollar, which trades with a drop of 0.69%. Slight increase ingold, which rises to $ 1,797.1 per ounce. Strong reduction in oil (Light Sweet Crude Oil) (-2.27%), which reached 92.2 dollars per barrel.

Advance just a little spreadwhich rises to +208 basis points, showing an increase of 4 basis points, with the yield of the 10-year BTP equal to 3.07%.

Among the markets of the Old Continent good performance for Frankfurtwhich grows by 0.74%, small steps forward for Londonwhich marks a marginal increase of 0.47%, and little moved Pariswhich shows a + 0.14%.

Slightly rising seat for Business Squarewith the FTSE MIB, which ends at 22,971 points, consolidating the series of three consecutive increases, started last Wednesday; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 25,021 points. The FTSE Italia Mid Cap (+ 0.35%); without direction the FTSE Italia Star (-0.14%).

On the Milan Stock Exchange, the exchange value in today’s session it was equal to 1.19 billion euro, down by 187.9 million euro, compared to 1.38 billion on the eve; volumes stood at 0.4 billion shares, compared with the previous 0.38 billion.

Between best performers of Milan, in evidence Telecom Italia (+ 6.04%), Nexi (+ 5.07%), Banco BPM (+ 4.04%) e Unicredit (+ 2.66%).

The worst performances, however, were recorded on Prysmianwhich closed at -2.86%.

Negative sitting for Amplifonwhich shows a loss of 1.88%.

Under pressure Leonardowhich shows a decrease of 1.46%.

It slips Recordatiwith a clear disadvantage of 1.33%.

Among the protagonists of the FTSE MidCap, Mfe A (+ 5.15%), Banca Popolare di Sondrio (+ 4.51%), MPS Bank (+ 3.82%) e Mfe B (+ 2.75%).

The strongest declines, on the other hand, occurred on Italmobiliarewhich closed the session at -2.20%.

In red GVSwhich shows a marked decline of 1.74%.

The negative performance of Carel Industrieswhich falls by 1.47%.

ERG drops by 1.42%.