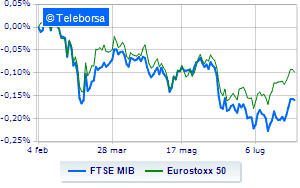

(Finance) – European stock exchanges move higher, while Piazza Affari lags behind, trading close to the values of the eve. Supporting the recovery of the markets are the positive indications of the US futures, which herald a positive start on Wall Street.

L’Euro / US dollar trading continues with a fractional gain of 0.45%. Slight increase ingold, which rises to $ 1,766.7 per ounce. Caution prevails on the oil market, with oil (Light Sweet Crude Oil) continuing the session with a slight drop of 0.25%.

He backs down a little spreadwhich reaches +216 basis points, showing a small decline of 4 basis points, while the yield of the 10-year BTP stands at 2.97%.

Among the European lists Frankfurt advances by 0.28%, flat Londonwhich holds parity, and moves modestly up Parisshowing an increase of 0.43%.

In Milan, the FTSE MIB is substantially stable and is positioned on 22,385 points, while, on the contrary, the FTSE Italia All-Share advances fractionally, reaching 24,520 points.

In money the FTSE Italia Mid Cap (+ 0.91%); with similar direction, the performance of the FTSE Italia Star (+ 0.86%).

Top of the ranking of the most important titles of Milan, we find Banco BPM (+ 3.35%), DiaSorin (+ 3.08%), BPER (+ 3.06%) e Amplifon (+ 2.26%).

The strongest falls, on the other hand, occur on Interpumpwhich continues the session with -1.67%.

Prey of the sellers Stellantiswith a decrease of 1.61%.

Basically weak ENIwhich recorded a decrease of 0.96%.

It moves below par Ternashowing a decrease of 0.77%.

Between best stocks in the FTSE MidCap there is Tod’s (+ 19.99%), which is in line with the price of Della Valle’s takeover bid, followed by Datalogic (+ 11.91%), GVS (+ 3.64%) e Ferragamo (+ 2.71%).

The worst performances, on the other hand, are recorded on Maire Tecnimontwhich gets -2.13%.

Sales focus on Ariston Holdingwhich suffers a decline of 1.97%.

Sales on Wiitwhich recorded a decline of 1.80%.

Negative sitting for Antares Visionwhich shows a loss of 1.51%.