(Tiper Stock Exchange) – Widespread purchases on European stock exchangeswith the FTSEMIB which scores the same positive performance as the Old Continent. To push the price lists, whose exchanges are limited for the bank holiday week and the closure of London, is also the further easing of measures against the coronavirus by the Chinese authorities. China will stop requiring incoming travelers to undergo a quarantine starting January 8, with people arriving in the country only needing to get negative Covid test results within 48 hours of departure.

This news does leap European luxury stocksalso because the giants of the sector rely heavily on Chinese buyers.

Negative mps extensiondespite the fact that the European Central Bank (ECB) has removed the ban on the distribution of dividendsreplacing it with the obligation for the Tuscan bank to obtain prior authorization from the Supervisory Authority.

Positive the Juventus on the day of the meeting for the approval of the financial statements as at 30 June 2022. “I am firmly convinced that he has done well in recent years and that the remarks made are unfounded“, said the outgoing president Andrea Agnelli in relation to the requests from the Turin prosecutor’s office for the indictment of Agnelli, his deputy Pavel Nedved, the former CEO Maurizio Arrivabene and nine other people, in addition to the company itself, for alleged false accounting in the last three years.

L’Euro / US Dollar remains substantially stable at 1.065. L’Gold trading continues with a fractional gain of 0.63%. Positive session for petrolium (Light Sweet Crude Oil), which shows a gain of 0.67%.

It retreats a little spreadswhich reaches +208 basis points, showing a small decrease of 3 basis points, while the yield on the 10-year BTP stands at 4.57%.

Among the indices of Euroland moderately good day for Frankfurtwhich rises by a fractional +0.68%, closed Londonand money up Pariswhich recorded an increase of 1.00%.

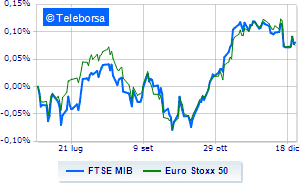

Business Square continue the session with a fractional gain on the FTSEMIB by 0.25%; along the same lines, slight increase for the FTSE Italia All-Sharewhich rises to 25,964 points.

Fractional earnings for the FTSE Italia Mid Cap (+0.68%); as well as, moderately rising the FTSE Italy Star (+0.58%).

At the top of the ranking of the most important titles of Milan, we find Moncler (+3.06%), Saipem (+1.35%), Azimuth (+1.16%) and Prysmian (+1.02%).

The strongest sales, on the other hand, show up ERGwhich continues trading at -1.01%.

Slow day for Inwitwhich marks a decrease of 0.66%.

Small loss for Nexiwhich trades with -0.51%.

Among the protagonists of the FTSE MidCap, GV extension (+7.42%), Intercos (+4.24%), Antares Vision (+2.72%) and Ariston Holding (+2.35%).

The worst performances, however, are recorded on Fincantieriwhich gets -1.68%.

He hesitates Bff Bankwhich drops 1.14%.

Basically weak Caltagirone SpAwhich recorded a decrease of 0.98%.

It moves below parity Maire Tecnimontshowing a decrease of 0.89%.

Between macroeconomic quantities most important:

Tuesday 12/27/2022

00:30 Japan: Unemployment rate (expected 2.5%; previous 2.6%)

00:50 Japan: Retail Sales, Annual (Expected 3.7%; Previous 4.3%)

2.30pm USA: Bulk inventory, monthly (previously 0.5%)

3pm USA: S&P Case-Shiller, annual (8% expected; previous 10.4%)

3pm USA: FHFA House Price Index, Monthly (exp. -0.6%; previous 0.1%).