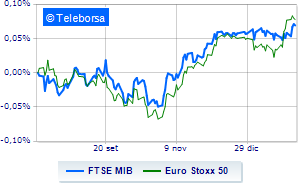

(Finance) – The main Euroland markets are moving in positive territory. On the same bullish trail the FTSE MIB. There is great anticipation among investors for today’s publication American employment report, which will give more indications to the Federal Reserve which, in the first monetary policy meeting of this year, curbed its bets on a rate cut at the next meeting in March. Insiders estimate a creation of new jobsin the month of January, by 180,000 units, against an unemployment rate growing to 3.8%.

On the currency market, theEuro / US Dollar continues trading with a fractional gain of 0.25%. No significant changes forgold, which trades on the day before at $2,054.8 per ounce. The oil market is substantially stable, continuing the session at the levels of the day before with oil (Light Sweet Crude Oil) trading at 74.06 dollars per barrel.

Unchanged spreadwhich is positioned at +159 basis points, with the yield on the 10-year BTP standing at 3.73%.

Among the Euroland indices Frankfurt advances by 0.71%, session without momentum Londonreflecting a moderate increase of 0.49%, and small step forward for Paris, which shows an increase of 0.52%. Slight increase for the Milan Stock Exchange, which shows on FTSE MIB an increase of 0.36%; along the same lines, the FTSE Italia All-Sharewhich rises to 32,966 points.

Between best Italian shares large-cap, is moving in positive territory Tenarisshowing an increase of 3.22%.

Money up Telecom Italiawhich records an increase of 3.16% with the MEF offer for Sparkle.

Definitely positive balance sheet for Campariwhich boasts an increase of 2.17%.

Good performance for Stellantiswhich grows by 2.09%.

The steepest declines, however, occur at Saipem, which continues the session with -0.97%. Weak ENIwhich lies just below the levels of the day before.

Lame Unicreditwhich shows a small decrease of 0.75%.

Modest descent for BPERwhich drops a small -0.54%.

Between best stocks in the FTSE MidCap, Philogen (+3.53%), Ariston Holding (+2.24%), Tod’s (+2.12%) e Juventus (+1.85%).

The steepest declines, however, occur at D’Amicowhich continues the session with -2.72%.

Sales up Intercoswhich recorded a decline of 2.11%.

Thoughtful Carel Industrieswith a fractional decline of 1.31%.

He hesitates Technoprobewith a modest decline of 0.93%.