(Finance) – The main Euroland markets are in positive territory. The Piazza Affari session follows the same bullish trend, despite the worsening of tensions in the Middle East, which have caused the price of oil to skyrocket. The United States and Britain struck Houthi military targets in Yemen overnight, in response to attacks carried out on commercial vessels in the Red Sea by the Iranian-backed militant group. Substantially stable theS&P-500 on the American market, which marks a percentage change of -0.11%, with attention paid to the indications coming from the company quarterly reports, with the first big banks that have released their results in these hours.

On the currency market, theEuro / US Dollar, which continues the session at the levels of the day before and stops at 1.096. L’Gold, increasing (+1.1%), reaches 2,051.6 dollars per ounce. No significant changes for the oil market, with oil (Light Sweet Crude Oil) remaining at the previous values at 73 dollars per barrel.

Unchanged spreadwhich is positioned at +159 basis points, with the yield on the 10-year BTP standing at 3.73%.

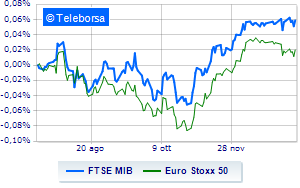

In the European stock market scenario good performance for Frankfurtwhich grows by 0.95%, substantially toned Londonwhich records a capital gain of 0.64%, is sustained Paris, with a decent gain of 1.05%. Earnings day for the Milan Stock Exchange, with the FTSE MIB, which shows a capital gain of 0.73%; along the same lines, the FTSE Italia All-Share it gains 0.75% compared to the previous session, closing at 32,580 points.

The value of trades in the session of 12/01/2024 on Piazza Affari was equal to 2.13 billion euros, down compared to the 2.26 billion on the day before; while the volumes traded went from 0.54 billion shares in the previous session to 0.49 billion.

Between best performers of Milan, highlighted Terna (+3.59%), Record yourself (+3.54%), Prysmian (+3.44%) e Saipem (+2.77%).

The worst performances, however, were recorded on Stellantiswhich closed at -0.75%.

Lame STMicroelectronicswhich shows a small decrease of 0.51%.

Among the protagonists of the FTSE MidCap, Fincantieri (+8.78%), Pharmanutra (+7.80%), Maire Tecnimont (+3.67%) e GVS (+3.39%).

The strongest sales, however, hit De Nora Industrieswhich ended trading at -2.40%.

Modest descent for Zignago Glasswhich drops a small -1.15%.