(Finance) – Major European exchanges expand earnings consolidating the rises of the eve, mainly supported by quarterly reportswhile the attention of investors remains focused on issues such as: inflation, war in Ukraine and return of Covid in China.

On the currency market, theEuro / US dollar is essentially stable and stops at 1.054, March 2020 levels, thus updating the low of the last five years. No significant change for thegold, which trades on the eve of 1,882.1 dollars an ounce. Oil (Light Sweet Crude Oil) falls slightly to $ 101.8 per barrel on fears of a decline in demand for fuel in China, the world’s largest oil importer, due to lockdowns.

It slightly reduces it spreadwhich reaches +175 basis points, with a slight decrease of 2 basis points, while the yield of the 10-year BTP stands at 2.59%.

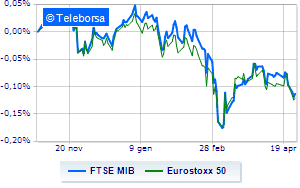

Among the markets of the Old Continent flies Frankfurtwith a marked increase of 1.93%, a positive trend for London, which is up by a decent + 0.89%; shines Paris, with a strong increase (+ 1.91%). Strong upside exchanges for the Milan stock exchange, with the FTSE MIB, which is posting a gain of 1.59%; on the same line, leap of FTSE Italia All-Sharewhich continues the day at 26,460 points.

Between best Italian stocks large cap, excellent performance for Stellantiswhich recorded a progress of 4.11%.

The controlling shareholder is also in high spirits Exor (+ 2.7%).

Exploit of STMicroelectronicswhich shows a rise of 3.83% in the aftermath of positive results.

Shopping hands-on Interpumpwhich boasts an increase of 2.59%.

The worst performances, on the other hand, are recorded on Saipemwhich gets -2.23%.

Lazy Snamwhich shows a small decrease of 0.53%.

Top of the ranking of mid-cap stocks from Milan, Maire Tecnimont (+ 4.14%), Brunello Cucinelli (+ 3.56%), Saint Lawrence (+ 3.07%) e SOL (+ 3.07%).

The strongest falls, on the other hand, occur on Aceawhich continues the session with -0.73%.

Modest descent for Italmobiliarewhich yields a small -0.67%.

Between macroeconomic quantities most important:

Thursday 28/04/2022

01:50 Japan: Industrial production, monthly (expected 0.5%; previous 2%)

01:50 Japan: Retail sales, annual (expected 0.4%; previous -0.9%)

9:00 am Spain: Unemployment rate, quarterly (expected 14.2%; previously 13.33%)

9:00 am Spain: Consumption prices, annual (expected 9%; previous 9.8%)

9:00 am Spain: Consumption prices, monthly (previous 3%).