(Finance) – The Milan stock market has moved little, as it does not align with the more tonic trend of the other Euroland stock exchanges, awaiting the US employment data due out soon.

Caution prevails overEuro / US Dollar, which continues the session with a slight decline of 0.23%. Substantially stable thegold, which continues the session at the levels of the day before at 2,027.5 dollars an ounce. Positive session for oil (Light Sweet Crude Oil), showing a gain of 2.06%.

Uphill it spreadwhich reaches +178 basis points, with an increase of 4 basis points, with the yield on the ten-year BTP equal to 4.02%.

In the European stock market scenario moderately positive day for Frankfurtwhich rises by a fractional +0.28%, little changed Londonwhich shows a +0.17%, and positive trend for Pariswhich advances by a discreet +0.73%.

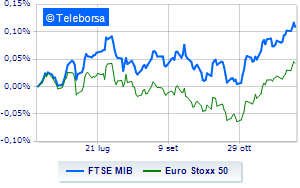

Substantially stable Piazza Affari, which continues the session at the levels of the day before, with the FTSE MIB which stops at 30,181 points, while, on the contrary, a small leap forward for the FTSE Italia All-Sharewhich reaches 32,158 points.

In fractional progress the FTSE Italia Mid Cap (+0.35%); on the levels of the day before FTSE Italia Star (+0.15%).

Between best performers of Milan, highlighted Moncler (+2.06%), Prysmian (+1.74%), Record yourself (+1.31%) e Inwit (+1.22%).

The strongest sales, however, occur at MPS Bankwhich continues trading at -1.94%.

Disappointing DiaSorinwhich lies just below the levels of the day before.

Lame BPERwhich shows a small decrease of 1.25%.

Modest descent for Azimuthwhich drops a small -0.58%.

Between best stocks in the FTSE MidCap, Ferragamo (+2.63%), Saras (+2.15%), Brunello Cucinelli (+1.95%) e Technogym (+1.73%).

The worst performances, however, are recorded on Pharmanutrawhich obtains -2.12%.

In red Ariston Holdingwhich highlights a sharp decline of 1.59%.

The negative performance of Carel Industrieswhich falls by 1.55%.

Thoughtful Eurogroup Laminationswith a fractional decline of 1.40%.

Among macroeconomic events which will have the greatest influence on market trends:

Friday 08/12/2023

00:30 Japan: Real household expenditure, monthly (expected -0.2%; previously 0.3%)

00:50 Japan: Current account (previously ¥2,724 billion)

00:50 Japan: GDP, quarterly (expected -0.5%; previously 1.2%)

07:30 France: Employment, quarterly (expected -0.1%; previously 0.1%)

08:00 Germany: Consumer prices, monthly (expected -0.4%; previously 0%).