(Finance) – The main Euroland markets are moving in positive territory, after data on European inflation which slowed down further in November. Waiting is also slowing down inflation in the United States, as it will arrive in the early afternoon. The intervention is scheduled for today ECB president, Christine Lagardeat the opening of the Forum on banking supervision, while tomorrow the Fed Chairman, Jerome Powell.

On the currency market, theEuro / US Dollar, which trades with a decline of 0.48%. Slight decline ingold, which falls to 2,038.4 dollars an ounce. Positive session for oil (Light Sweet Crude Oil), showing a gain of 0.67%.

Slight worsening of spreadwhich rises to +175 basis points, with an increase of 2 basis points, with the yield on the 10-year BTP equal to 4.20%.

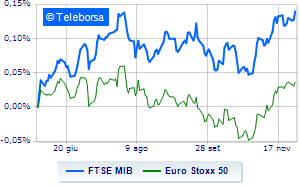

Among the main European stock exchanges substantially toned Frankfurtwhich records a capital gain of 0.44%, a moderate gain for Londonwhich advances by 0.60%, and small steps forward for Paris, which marks a marginal increase of 0.49%. Slight increase for the Milan Stock Exchange, with the FTSE MIB which rises by 0.46% to 29,825 points, continuing the positive streak that began last Tuesday; along the same lines, the FTSE Italia All-Share proceeds in small steps, advancing to 31,777 points.

Among the best Blue Chips of Piazza Affari, takes off Tenaris, with an important progress of 4.04%. Well bought Saipemwhich marks a strong increase of 3.73%.

STMicroelectronics advances by 2.72%.

It is moving into positive territory Leonardoshowing an increase of 2.16%.

The steepest declines, however, occur at Unicreditwhich continues the session with -1.13%.

Basically weak Herawhich recorded a decline of 1.03%.

It moves below parity Ferrarihighlighting a decrease of 0.89%.

Moderate contraction for Ternawhich suffers a drop of 0.70%.

Between best stocks in the FTSE MidCap, Seco (+2.58%), Saras (+2.41%), Saint Lawrence (+2.18%) e Alerion Clean Power (+1.71%).

The steepest declines, however, occur at Cementirwhich continues the session with -2.11%.

Prey for sellers Ferragamowith a decrease of 1.71%.

They focus on sales Intercoswhich suffers a drop of 1.70%.

Undertone IREN which shows a reduction of 1.46%.