(Finance) – Brilliant business square, which is in line with the excellent performance of the main European stock exchanges. On the New York stock market, theS & P-500where tensions remain over the war in Ukraine and the US and EU sanctions against Russia.

On the currency market, theEuro / US dollar, which continues the session on the eve of levels and stops at 1.087. Slightly raised seat for thegold, which advances to $ 1,944.2 per ounce. Plus sign for oil (Light Sweet Crude Oil), up 1.12%.

Slight improvement of the spreadwhich drops up to +165 basis points, with a decrease of 3 basis points, while the yield of the 10-year BTP stands at 2.36%.

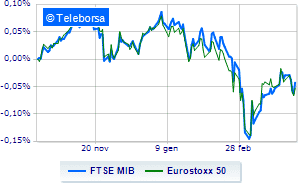

Among the markets of the Old Continent money on Frankfurtwhich recorded an increase of 1.46%, incandescent London, which boasts an incisive increase of 1.56%; definitely positive balance for Paris, which boasts an increase of 1.34%. In Milan, the FTSE MIB (+ 2.13%), which reaches 24,819 points, reversing the trend compared to the series of three consecutive declines, which began last Tuesday, while, on the contrary, it is positioned below the parity line. FTSE Italia All-Sharewhich stops at 26,532 points.

At the close of the Milan Stock Exchange, the exchange value in today’s session it was equal to 2.35 billion euro, a marked decrease (-17.1%), compared to the previous session which had seen the negotiation of 2.84 billion euro; while the volumes traded went from 0.85 billion shares of the previous session to today’s 0.69 billion.

Between best performers of Milan, in evidence Banco BPM (+ 10.24%) after Crédit Agricole got its hands on 9.2% of the Milanese bank’s capital. Fly Atlantia with the market betting on Edition and Blackstone ready to launch a takeover bid at Easter (+ 8.72%).

Well in the wake of oil Tenaris (+ 4.50%) ed ENI (+ 4.19%).

The strongest declines, on the other hand, occurred on Amplifonwhich closed the session at -2.10%.

Disappointing Nexiwhich lies just below the levels of the eve.

Lazy Telecom Italiawhich shows a small decrease of 0.93% after the board of directors denied KKR access to due diligence aimed at a binding offer for the group.

Modest descent for Campariwhich yields a small -0.69%.

Top of the ranking of mid-cap stocks from Milan, Anima Holding (+ 7.89%), Mutuionline (+ 5.77%), Banca Popolare di Sondrio (+ 4.83%) e Credem (+ 4.45%).

The strongest declines, on the other hand, occurred on Alerion Clean Powerwhich closed the session at -6.02%.

Thud of Salcef Groupwhich shows a drop of 3.54%.

Prey of the sellers Intercoswith a decrease of 1.97%.

Thoughtful Carel Industrieswith a fractional decline of 0.91%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Friday 08/04/2022

01:50 Japan: Current items (¥ 1,436.8 billion expected; ¥ -1,188.7 billion previously)

10:00 Italy: Retail sales, annual (previous 8.3%)

10:00 Italy: Retail sales, monthly (previous -0.6%)

4:00 pm USA: Wholesale stocks, monthly (expected 2.1%; previous 1.2%)

Monday 11/04/2022

02:30 China: Production prices, annual (expected 8.7%; previous 8.8%).