(Tiper Stock Exchange) – The Milan Stock Exchange shines on the main European lists, which show good earnings, thanks above all to increases in the banking and automotive sectors. However, the climate is wait-and-see, with investors waiting for i speeches by Jerome Powell and Christine Lagardescheduled for today at the US Federal Reserve’s Jackson Hole symposium.

On the macroeconomic front, in Germany the second reading confirmed the GDP stagnation in the 2nd quarter, with the positive contribution of domestic demand and inventories offset by the negative contribution of foreign trade, while theIFO index contracted again in August, to a level consistent with a contraction in GDP in the 3rd quarter. In Spaini producer prices they confirmed their sharp decline in July.

No significant change for theEuro / US Dollar, which trades on the previous day’s values of 1.081. Basically stable thegold, which continues the session on the previous day’s levels at 1,917.5 dollars an ounce. Plus sign for petrolium (Light Sweet Crude Oil), up 1.38%.

On equality it spreadswhich remains at +169 basis points, with the yield of the 10-year BTP which stands at 4.23%.

Among the indices of Euroland composed Frankfurtwhich grows by a modest +0.51%, a modest performance for Londonshowing a moderate gain of 0.50%, and money up Pariswhich recorded an increase of 0.73%.

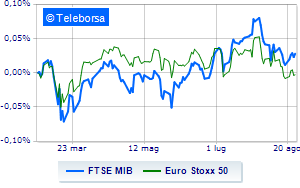

Positive session for Milanese price listwhich shows a gain of 1.02% on the FTSEMIB; along the same lines, the FTSE Italia All-Share the day continues with an increase of 0.96%. In fractional progress the FTSE Italia Mid Cap (+0.37%); as well, just above parity the FTSE Italy Star (+0.36%).

Among the best Blue Chips of Piazza Affari, buy hands-on Iveco, which boasts an increase of 4.44%. Very positive balance for Unicredit, which boasts an increase of 2.07%. Good performance for Prysmian, which grows by 1.58%. sustained General Bankwith a decent gain of 1.56%.

Weak Erg And DiaSorin.

Between best stocks in the FTSE MidCap, Juventus (+3.10%), Zignago Glass (+3.03%), Alerion Clean Power (+2.19%) and Salcef Group (+2.08%).

The strongest declines, however, occur on GV extension, which continues the session with -1.77%. Bad sitting for De Nora Industries, which shows a loss of 1.60%. Moderate contraction for Antares Vision, which suffers a drop of 1.21%. Undertone Saphilus showing a filing of 0.98%.