(Finance) – Two-speed sitting for Wall Streetwith the Dow Jones in good earnings and the Nasdaq that remains further behind, waiting for the results of the tech giants. Among the quarterly reports that will be released after the market closes are Cadence Design, Alexandria RE and Discover. More exciting data will arrive later in the week with Apple, Microsoft, Meta, Exxon Mobil, Ford, Alphabet, Amazon, Boeing, Caterpillar, Coca-Cola, Intel, McDonald’s, UPS and Visa.

Tesla has cut prices starting point of Model 3 and Model Y cars up to 9% in Chinaafter founder Elon Musk said last week that “some sort of recession” is underway in China and Europe.

Eyes points on shares of Chinese companies, after the collapse of the markets of Hong Kong and mainland China in today’s session. Investors are frightened by the outcome of the Communist Party Congress, with the consolidation of the power of Xi Jinping which raises fears of a new campaign against the largest corporations in the country and the wealthiest businessmen.

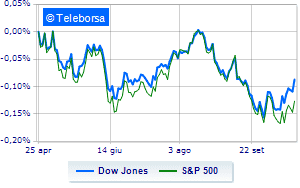

The USA price list shows a gain, with the Dow Jones which is achieving + 0.65%; on the same line, theS & P-500 advances fractionally, reaching 3,779 points. Without direction the Nasdaq 100 (+ 0.04%); in fractional progress theS&P 100 (+ 0.6%).

In good evidence in the S&P 500 i compartments consumer goods for the office (+ 1.56%), utilities (+ 1.47%) e sanitary (+ 1.38%).

Between protagonists of the Dow Jones, Amgen (+ 2.18%), Verizon Communication (+ 2.04%), Coke (+ 2.02%) e American Express (+ 2.01%).

Between best performers of the Nasdaq 100, Comcast (+ 2.66%), Kraft Heinz (+ 2.61%), Amgen (+ 2.18%) e O’Reilly Automotive (+ 2.17%).

The worst performances, on the other hand, are recorded on Pinduoduo Inc Spon Each Repwhich gets -22.81%.

Breathless JD.comwhich falls by 17.05%.

Thud of Baiduwhich shows a fall of 15.94%.

Letter on NetEasewhich records a significant decline of 10.27%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Monday 24/10/2022

15:45 USA: Manufacturing PMI (expected 51 points; preceding 52 points)

15:45 USA: PMI services (expected 49.2 points; preceding 49.3 points)

15:45 USA: Composite PMI (preceding 49.5 points)

Tuesday 25/10/2022

15:00 USA: S&P Case-Shiller, annual (expected 14.4%; previous 16.1%)

15:00 USA: FHFA house price index, monthly (previous -0.6%).