(Tiper Stock Exchange) – Rally session in Piazza Affari, which is in line with the sensational day of the European stock exchanges, thanks to the mini rebound achieved by the banks in the wake of the cover-ups after the slide on the eve linked to the surprise announcement of the tax on extra profits. According to insiders, the introduction, in the evening, of a ceiling on the extraordinary contribution on extra profits, would reduce the impact of the tax on credit institutions.

In the background remain the data arrived from China slip into deflation which, after the disappointing ones on exports yesterday, reinforce the idea of a slowdown in global demand. “Although there are fears about deflation in China, we are not too worried – he explains Brendan Ahern, Chief Investment Officer of KraneShares -. China’s economic policy has been relatively non-interventionist over the past year, so the central bank still has plenty of ammunition left. Because of this the situation is different than in Japanwhich has experienced deflation for a long time until recently, despite a decidedly accommodative monetary policy”.

On the foreign exchange market, theEuro / US Dollar the session continued at the previous levels, reporting a variation of +0.2%. Basically stable thegold, which continues the session on the previous day’s levels at 1,928.1 dollars an ounce. Light Sweet Crude Oil was up slightly, advancing to $83.36 per barrel.

It is reduced by a little spreadswhich reaches +165 basis points, with a slight decrease of 3 basis points, while the yield on the 10-year BTP stands at 4.09%.

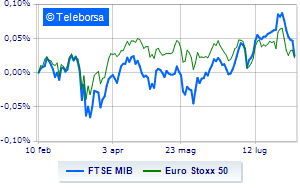

Among the European lists moves into positive territory Frankfurtshowing an increase of 1.25%, money up Londonwhich records an increase of 0.83%, and a decidedly positive balance for Paris, which boasts an increase of 1.47%. In Milan, the FTSEMIB (+2.05%), which reaches 28,515 points, reversing the trend with respect to the series of six consecutive declines, which began on the first of this month; on the same line, forcefully advances the FTSE Italia All-Sharewhich continues trading at 30,517 points.

At the top of the ranking of the most important titles of Milan, we find the banks: Phinecus (+5.40%), MPS Bank (+4.82%), Unicredit (+4.14%) and Mediolanum Bank (+3.74%).

At the top among Italian stocks a mid-cap, Banca Popolare di Sondrio (+2.96%), MARR (+2.70%), BFF Bank (+2.56%) and Cembre (+2.43%).

The strongest sales, on the other hand, show up Italmobiliarewhich continues trading at -1.01%.