(Finance) – Piazza Affari shines, unlike the main European stock exchanges which remain anchored to the values of the eve, following the Fed which, as expected, raised interest rates by 75 basis points. However, President Jerome Powell has opened up to the possibility that we may soon move to a slower pace of hikes.

On the corporate front, better than expected results for Iveco and Stellantis. Moncler and STM are also in evidence thanks to the balance sheet accounts.

On the currency market, theEuro / US dollar it is basically stable and stops at 1.02. Plus sign forgold, which shows an increase of 0.73%. Slight increase for oil (Light Sweet Crude Oil), which shows an increase of 1.46%.

Unchanged it spreadwhich is positioned at +245 basis points, with the yield of the ten-year BTP standing at 3.36%.

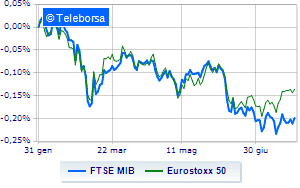

Among the Euroland indices moves below par Frankfurtshowing a decrease of 0.25%, moderate contraction for London, which suffers a decline of 0.33%; without cues Paris, which does not show significant changes in prices. Plus sign for the Italian price list, with the FTSE MIB up by 1.08%; on the same line, the FTSE Italia All-Sharewhich increases compared to the day before reaching 23,808 points.

Between best performers of Milan, in evidence Moncler (+ 4.98%), Stellantis (+ 3.70%), CNH Industrial (+ 2.96%) e Pirelli (+ 2.91%).

The strongest falls, on the other hand, occur on Saipemwhich continues the session with -3.22%.

Suffers Leonardowhich shows a loss of 1.20%.

Undertone Terna which shows a filing of 0.76%.

Disappointing Snamwhich lies just below the levels of the eve.

Top of the ranking of mid-cap stocks from Milan, Brembo (+ 5.14%), Tod’s (+ 3.98%), Tinexta (+ 3.33%) e Wiit (+ 3.28%).

The strongest falls, on the other hand, occur on Fincantieriwhich continues the session with -2.76%.

Breathless Ariston Holdingwhich falls by 2.21%.

Prey of the sellers Aceawith a decrease of 1.30%.

Sales focus on ERGwhich suffers a decline of 1.10%.

Between macroeconomic quantities most important:

Thursday 28/07/2022

08:45 France: Production prices, monthly (previous -0.3%)

9:00 am Spain: Unemployment rate, quarterly (expected 13%; previous 13.65%)

9:00 am Spain: Retail sales, annual (expected 1.3%; previous 1.3%)

9:00 am Spain: Retail sales, monthly (previous -0.1%)

10:00 Italy: Industry turnover, monthly (previous 2.8%).