(Finance) – The Milan Stock Exchange remains prudent along with the rest of the Eurolandafter the data fromSpanish inflation they confirmed an acceleration., in view of the meeting of ECB Thursday.

L’Euro / US Dollar the session continues just below parity, with a drop of 0.28%. Substantially stable thegold, which continues the session at the levels of the day before at 1,919.8 dollars an ounce. Oil (Light Sweet Crude Oil) shows a modest gain and marks a +0.63%.

It retreats slightly spreadwhich reaches +173 basis points, showing a small drop of 2 basis points, while the yield on the 10-year BTP stands at 4.35%.

In the European stock market scenario neglected Frankfurtwhich remains glued to the levels of the day before, substantially toned Londonwhich records a capital gain of 0.69%, and nothing has been done for Pariswhich changes hands on parity.

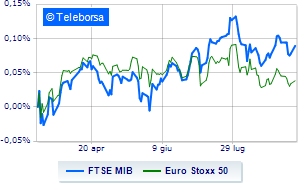

Slight increase for the Milan Stock Exchange, with the FTSE MIB which rises by 0.21% to 28,584 points, while, on the contrary, it moves around parity on FTSE Italia All-Sharewhich continues the day at 30,544 points.

Under parity the FTSE Italia Mid Cap, which shows a decline of 0.29%; along the same lines, slightly negative FTSE Italia Star (-0.39%).

At the top of the ranking of the most important titles of Milan, we find Stellantis (+1.74%), Saipem (+1.23%), Amplifon (+1.00%) e Record yourself (+0.95%).

In deep red Campariwhich marks -4.34% after the announcement of scheduled collection of the historic CEO Bob Kunze-Concewitz.

Sales also up Ivecowhich suffers a decline of 3.02%.

Slow day for MPS Bankwhich marks a decline of 0.89%.

Small loss for Interpumpwhich trades at -0.79%.

At the top among Italian shares a mid-cap, SOL (+1.86%) e Maire Tecnimont (+1.05%).

The worst performances, however, are recorded on Antares Visionwhich fell by 13.40%.

Sales up CIRwhich recorded a decline of 1.61%.

He hesitates Pharmanutrawhich lost 1.45%.

Basically weak Datalogicwhich recorded a decline of 1.41%.