(Tiper Stock Exchange) – The main Euroland markets are in positive territory. Piazza Affari remains a little behind, even if a session without great ideas and volumes ends with a plus sign, due to the long festive bridge started with Sant’Ambrogio in Milan and continued with the Immaculate Conception throughout Italy.

Negative Leonardodespite the news on the consolidation of the collaboration between Italy, UK and Japan for the “Global Combat Air Programme” (Gcap), aimed at the realization of the new generation of fighter aircraft.

positive Prysmianafter the go-ahead for the works of thesubmarine electrical interconnection between Italy and Tunisia by Triad. The analysts of Equity write that “Terna is one of Prysmian’s main customers” and that “the news improves visibility on the pipeline of acquisitions of new orders, which is already very good”.

Little move UniCreditwhich expects “no impact on distribution policies” from the fact that the Pillar 2 Capital Requirement (P2R) “could increase minimally” from the current level of 175 basis points.

L’Euro / US Dollar it is substantially stable and stops at 1.056. Positive session forgold, which is taking home a gain of 0.74%. Slight increase of Petroleum (Light Sweet Crude Oil) which rises to 72.33 dollars per barrel.

On the levels of the eve it spreadswhich remains at +188 basis points, with the yield of 10-year BTP which stands at 3.80%.

Among the indices of Euroland sustained Frankfurtwith a decent gain of 0.74%, flat Londonholding parity, and sitting without momentum for Parisreflecting a moderate increase of 0.46%.

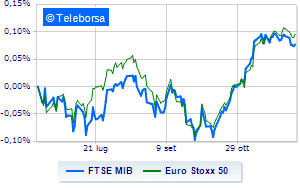

Business Square archive the day with a fractional gain on the FTSEMIB by 0.29%, while, on the contrary, the day ended without infamy and without praise FTSE Italia All-Sharewhich remains at 26,228 points.

Good performance of FTSE Italia Mid Cap (+0.96%); as well as, rising the FTSE Italy Star (+1.12%).

At the close of the Milan Stock Exchange, the exchange value in today’s session it appears to have been equal to 1.28 billion euros, a decided decrease (-19.09%), compared to the previous session which had seen the negotiation of 1.59 billion euros; while the volumes traded went from 0.41 billion shares in the previous session to today’s 0.3 billion.

Between best Italian stocks large-cap, good insights on Interpumpshowing a large lead of 2.96%.

Well set up Buzzi Unicemwhich shows an increase of 2.38%.

Toned Prysmian which shows a nice advantage of 2.22%.

In light Monclerwith a large progress of 1.84%.

The strongest declines, however, occurred on Stellantiswhich closed the session at -2.54%.

Prey of sellers Leonardowith a decrease of 1.65%.

Slack Nexiwhich shows a small decrease of 1.00%.

Modest descent for Tenariswhich drops a small -0.87%.

Among the protagonists of the FTSE MidCap, Carel Industries (+3.73%), Caltagirone SpA (+3.66%), Salcef Group (+2.73%) and SOL (+2.44%).

The strongest sales, however, fell on Piaggiowhich finished trading at -1.22%.

Thoughtful Ascopiavea fractional decline of 1.00%.

He hesitates Juventuswith a modest drop of 0.71%.

Slow day for wiitwhich marks a decrease of 0.61%.