(Tiper Stock Exchange) – Excellent day for the Milan Stock Exchange, which stands out on the main European price lists, which have remained at the starting line. Christine Lagarde, president of the European Central Bank, said that Frankfurt plans to raise rates further and that the ECB will also have to “normalize the other instruments and thus strengthen the momentum of interest rate policy”.

The Frankfurt number one also underlined that, in an economic environment characterized by “multiple shocks and profound uncertainty”, the Eurozone must not water down banking sector regulation, risking ending up with weaker banks and, ultimately, less credit all ‘economy.

On the foreign exchange market, theEuro / US Dollar remains substantially stable at 1.035. Weak session forgold, which trades 0.36% lower. Strong reduction in oil (Light Sweet Crude Oil) (-3.21%), which reached 79.02 dollars per barrel.

Excellent level of spreadswhich drops to +184 basis points, with a drop of 10 basis points, with the yield on the 10-year BTP standing at 3.87%.

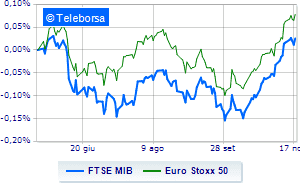

Among the European lists good performance for Frankfurtwhich grows by 1.23%, essentially tonic Londonwhich records a capital gain of 0.53%, and sustained Paris, with a decent gain of 1.04%. Closing plus sign for the Italian price list, with the FTSEMIB up 1.38%. Fitch’s judgment on Italy is expected in the evening with the expectation of confirmation of the BBB rating with a stable outlook.

On the Milan Stock Exchange it appears that the value of trades in today’s session was equal to 2.14 billion euros, an increase compared to the 1.92 billion of the previous session; while the volumes traded today went from 0.56 billion shares in the previous session to today’s 0.62 billion.

At the top of the ranking of the most important titles of Milan, we find Is in the (+3.14%), CNH Industrial (+2.98%), Iveco (+2.73%) and Pirelli (+2.26%).

The strongest declines, however, occurred on Azimuthwhich closed the session at -1.23%.

At the top of the mid-cap rankings from Milan, Luve (+3.90%), Banca Ifis (+3.29%), Webuild (+3.04%) and Cementir Holding (+2.89%).

The worst performances, however, were recorded on Alerion Clean Powerwhich closed at -2.21%.

They focus their sales on CIRwhich suffers a drop of 1.86%.

Sales on GV extensionwhich records a drop of 1.55%.

Disappointing Salcef Groupwhich lies just below the levels of the eve.

Between macroeconomic quantities most important:

Friday 11/18/2022

half past one Japan: Consumption prices, yearly (previously 3%)

08:00 United Kingdom: Retail sales, monthly (exp. 0.3%; previous -1.5%)

08:00 United Kingdom: Retail sales, annual (exp. -6.5%; previous -6.8%)

4:00 pm USA: Sale of existing houses (expected 4.38 million units; previous 4.71 million units)

4:00 pm USA: Existing home sales, monthly (previously -1.5%).