(Finance) – Piazza Affari building, following the main European markets. The indices recorded lows in recent months weighed down by the remodulation regarding the continuation of high rates for a longer period than expected. This morning they were published consumer confidence in September both in Germanywhere it drops to -26.5 from -25.5 (expected -26) according to the GfK index, both in France where it drops to 83 (expected 84), which leaves the index above the levels reached in the 1st half of the year, but still below the historical average.

Interest rates could still riseif necessary, he said Frank Elderson, member of the Governing Council of the ECB. “Does this mean interest rates have peaked? Not necessarily,” she told Market News International in an interview published today.

L’Euro / US Dollar it is essentially stable and stops at 1.057. L’Gold the session continues just below parity, with a drop of 0.23%. Positive session for the petrolium (Light Sweet Crude Oil), showing a gain of 1.13%.

On equality, yes spreadwhich remains at +191 basis points, with the yield of the ten-year BTP which stands at 4.71%. The focus will be on the presentation of the Update Note to the DEF, with the new public finance numbers which could further fuel volatility on domestic debt.

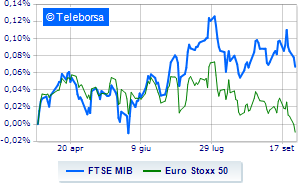

Among the markets of the Old Continent little moved Frankfurtwhich shows +0.07%, essentially unchanged Londonwhich reports a moderate +0.03%, and session without momentum for Parisreflecting a moderate increase of 0.24%.

TO MilanThe FTSE MIB it is substantially stable and stands at 28,118 points; on the same line, colorless the FTSE Italia All-Share, which continues the session at 29,950 points, on the previous day’s levels. In fractional progress the FTSE Italia Mid Cap (+0.55%); as well, rising the FTSE Italia Star (+1.04%).

Between best performers of Milan, highlighted Nexi (+1.75%), DiaSorin (+1.72%), Ferrari (+1.36%) e Amplifon (+1.24%).

The strongest sales, however, occur at MPS Bank, which continues trading at -3.87%. He hesitates Hera, which lost 1.41%. Basically weak BPER, which recorded a decline of 1.41%. It moves below parity A2Ahighlighting a decrease of 1.28%.

Between best stocks in the FTSE MidCap, El.En (+5.90%), Reply (+4.19%), Tinexta (+2.68%) e GVS (+2.04%).

The steepest declines, however, occur at Antares Vision, which continues the session with -2.31%. They focus on sales Saras, which suffers a decline of 2.19%. Sales up IREN, which recorded a decline of 2.05%. Negative session for CIRwhich shows a loss of 1.66%.