(Tiper Stock Exchange) – Piazza Affari ends the session with a good riseresulting in the best among the European price lists thanks to greater weight of the banks in the main indices. Italian banks benefit from the strong start to the US banking quarterly season, with JPMorgan Chase (first quarter profit up 52%), citigroup (first quarter profit up 7%) e Wells Fargo (first quarter profit rises by 32%) which beat analysts’ estimates thanks above all to the increase in interest rates, signaling the resilience of the sector after the crisis which affected several regional banks in March.

Caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.57%. collapse ofgold (-2.06%), which reached 1,998 dollars an ounce. The Petrolium (Light Sweet Crude Oil) shows a modest gain and marks a +1.01%.

On the levels of the eve it spreadswhich remains at +181 basis points, with the yield of 10-year BTP which stands at 4.21%.

In the European stock market scenario composed Frankfurtwhich grows by a modest +0.5%, a modest performance for Londonshowing a moderate gain of 0.36%, and resistant Pariswhich marks a small increase of 0.52%.

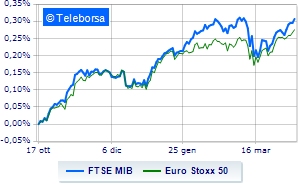

Plus sign for Italian price listwith the FTSEMIB up 0.90%; along the same lines, positive performance for the FTSE Italia All-Share, which continues the day up 0.83% compared to the previous close. Moderately up the FTSE Italia Mid Cap (+0.33%); consolidates the levels of the eve the FTSE Italy Star (+0.09%).

At the top of the ranking of the most important titles of Milan, we find BPER (+4.67%), Phinecus (+4.52%), Intesa Sanpaolo (+3.37%) and BPM desk (+3.35%).

The strongest declines, however, occur on Hera, which continues the session with -2.82%. Slide snam, with a clear disadvantage of 2.19%. In red Triad, which shows a marked decrease of 2.10%. The negative performance of DiaSorinwhich drops by 1.80%.

At the top among Italian stocks a mid-cap, Intercos (+3.57%), Brunello Cucinelli (+2.94%), believe (+2.50%) and Ferragamo (+2.45%).

The strongest sales, on the other hand, show up IRENwhich continues trading at -2.93%. Saras drops by 2.38%. Decided decline for SOL, which marks a -2.24%. Under pressure Webuildwith a sharp drop of 2.17%.