(Finance) – The Milan stock exchange proceeds fractionally up, doing slightly better than the rest of Euroland which travels on par. The markets remain focused on the Fed’s next moves, which are not at all discounted despite the positive inflation figures. In a quiet climate typical of August, some Bue-Chips stores stand out.

Caution prevails onEuro / US dollar, which continues the session with a slight decrease of 0.32%. Substantially stable thegold, which continues the session on the eve of the levels at 1,786.7 dollars an ounce. Slight drop in oil (Light Sweet Crude Oil), which drops to 93.5 dollars per barrel.

Slight worsening of the spreadwhich rises to +207 basis points, with an increase of 3 basis points, with the yield of the 10-year BTP equal to 3.04%.

Among the main European stock exchanges small steps forward for Frankfurtwhich marks a marginal increase of 0.39%, a moderately positive day for Londonwhich rises by a fractional + 0.27%, and without cues Pariswhich does not show significant changes in prices.

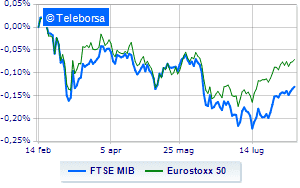

Piazza Affari continues the session with a fractional gain on FTSE MIB by 0.21%, while, on the contrary, it moves around parity on FTSE Italia All-Sharewhich continues the day at 25,066 points.

Consolidate eve levels on FTSE Italia Mid Cap (-0.01%); just below parity the FTSE Italia Star (-0.5%).

Between best Italian stocks large-cap, it shines Nexi with a strong increase (+ 5.41%), reflecting the rumors of interest of a private equity company.

Excellent performance for TIMwhich recorded a progress of 4.14%, after Bloomberg wrote about a project of semi-nationalization of the Group rocked by the Brothers of Italy with the intervention of CDP.

Exploit of Banco BPMwhich shows a rise of 2.27%, while Unicredit advances by 1.09%.

Among the strongest falls it should be noted Prysmianwhich continues the session with -2.50%.

Decline decided for Amplifonwhich marks a -1.44%.

Under pressure DiaSorinwith a sharp decline of 1.28%.

Suffers STMicroelectronicswhich shows a loss of 1.18%.

Among the protagonists of the FTSE MidCap, Banca Popolare di Sondrio (+ 3.78%), doValue (+ 2.27%), Mfe A (+ 2.00%) e Ariston Holding (+ 1.94%).

The strongest falls, on the other hand, occur on Replywhich continues the session with -2.02%.

Prey of the sellers GVSwith a decrease of 1.79%.

Sales focus on Sesawhich suffers a decrease of 1.35%.

Sales on Ferragamowhich recorded a decline of 1.18%.