(Finance) – Piazza Affari sinks after Mario Draghi repeated his resignation his and the government he chaired by Sergio Mattarella. The President of the Republic took note of this and announced that the government remains in office for the handling of current affairs. With the country getting closer to the polls, the Italian 10-year yield rose to 3.57%, settling at the same rate as Greek bonds. The spread is also growing, on which today’s decision by the ECB to increase rates and to present an anti-fragmentation tool.

“The main consequences that we see at the market level are a rise in the spread due to political uncertainty (even if we expect a mitigating intervention from the ECB and therefore without exceeding the 326 bps touched by the 2018 crisis), a increased risk of executing PNRR plansalso due to the possible paralysis of some reforms (eg DL competition), a risk of delays for some politically sensitive dossiers (eg only network, Rai Way / EI Towers) “, write the analysts of Equity.

On the macroeconomic front, the day is devoid of significant data in the Old Continent. It got worse confidence of French manufacturing firms in the month of July.

The quarterly reports continue. Thales improved guidance for the whole of 2022 after a positive first half. Roche reported core earnings up in the first half of the year and announced top changes in 2023. ABB reported a decline in profits due to the exit from some businesses and the decision to leave Russia.

No significant change for theEuro / US dollar, which trades on the eve of 1.019. Sitting in fractional reduction for thegold, which for now leaves 0.57% on the parterre. Day to forget for Petroleum (Light Sweet Crude Oil), which is trading at $ 96.78 per barrel, down by 3.10%.

Salt a lot spreadreaching +233 basis points, with a marked increase of 19 basis points, while the BTPs with a 10-year maturity reports a yield of 3.58%.

In the European stock market scenario in red Frankfurtwhich shows a marked decline of 0.82%, is moving below par Londonshowing a decrease of 0.37%, and a moderate contraction for Pariswhich suffers a 0.29% decline.

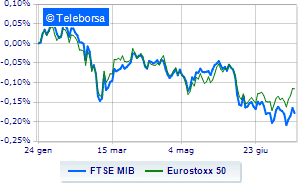

Overlooking Piazza Affariwith the FTSE MIB which accuses a decrease of 2.22%; along the same lines, sales on the FTSE Italia All-Share, which continues the day at 22,910 points, down sharply by 2.16%. Depressed the FTSE Italia Mid Cap (-1.71%); as well as, in decline the FTSE Italia Star (-1.05%).

Top of the ranking of the most important titles of Milan, we find DiaSorin (+ 1.90%), Amplifon (+ 1.28%), Campari (+ 1.19%) e Prysmian (+ 0.85%).

The strongest sales, on the other hand, show up on Unicreditwhich continues trading at -6.97%.

Heavy Banco BPMwhich marks a drop of as much as -6.77 percentage points.

Negative sitting for Italian postwhich falls by 6.53%.

The negative performance of Intesa Sanpaolowhich falls by 5.81%.

At the top among Italian stocks a mid cap, Italmobiliare (+ 2.11%), Alerion Clean Power (+ 2.01%), GVS (+ 1.51%) e Autogrill (+ 0.59%).

The worst performances, on the other hand, are recorded on Saraswhich gets -5.71%.

MPS Bank drops by 4.93%.

Sensitive losses for Secodown 4.58%.

Breathless Webuildwhich fell by 4.43%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Thursday 21/07/2022

01:50 Japan: Trade balance (expected ¥ -1.509.7 billion; previous ¥ -2.385.8 billion)

14:30 USA: Unemployment Claims, Weekly (Expected 240K Units; Previous 244K Units)

14:30 USA: PhillyFed (expected -2.5 points; prev. -3.3 points)

4:00 pm USA: Leading indicator, monthly (expected -0.5%; previous -0.4%)

Friday 22/07/2022

half past one Japan: Consumption prices, annual (previous 2.5%).