(Finance) – Piazza Affari is stable, not following the moderately bullish trend of the main European markets. The group’s rise stands out Unipolfollowing the announcement of a plan to shorten the chain of control that involves the incorporation of UnipolSai. CEO Carlo Cimbri explained that the operation “closes a process that began ten years ago, started with the acquisition of Fondiaria, which led to the gradual restructuring of the group”. Down Eniafter the release of quarterly results substantially in line with analysts’ expectations, with top management confirming Plenitude’s path towards the IPO, even if favorable market conditions are needed.

On the macroeconomic front, i French consumer prices they increased 3.4% year-on-year in January, confirming preliminary data released last month.

For what concern interest rate cut by the ECBthe governor of the Bank of France Francois Villeroy de Galhau he said that “it’s not about rushing things, but about acting gradually and pragmatically, rather than deciding too late and then having to adapt too much”. Isabel Schnabelwho is part of the Executive Board of the ECB, explained that persistently low productivity growth “increases the risk that businesses pass on higher wage costs to consumers, which could delay the return of inflation to our target of 2%”.

L’Euro / US Dollar it is essentially stable and stops at 1.077. Slightly rising seat for thegold, which advances to 2,009.9 dollars an ounce. Slight increase in petrolium (Light Sweet Crude Oil) which rises to 78.58 dollars per barrel.

Downhill it spreadwhich retreats to +147 basis points, with a decrease of 3 basis points, while the Ten-year BTP reports a yield of 3.85%.

Among the Euroland indices resistant Frankfurtwhich marks a small increase of 0.42%, in the foreground Londonwhich shows a strong increase of 1.50%, and Paris advances by 0.32%.

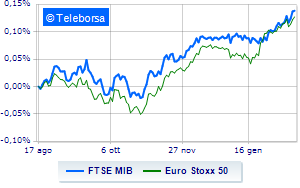

No significant change in closing for Milanese price listwith the FTSE MIB which stands at 31,732 points on the day before; on the same line, it remains around the parity line the FTSE Italia All-Share, which closed the day at 33,864 points. Salt the FTSE Italia Mid Cap (+0.71%); on the same trend, slightly positive FTSE Italia Star (+0.39%).

The exchange value in the session of 02/16/2024 it was equal to 3.01 billion euros, up compared to the 2.9 billion on the day before, while the volumes stood at 0.69 billion shares, compared to the 0.68 billion precedents.

Among the best Blue Chips of Piazza Affari, takes off Unipol, with an important progress of 21.03%. In light Brunello Cucinelli, with a large increase of 1.82%. Positive trend for Prysmian, which advances by a discreet +1.79%. Well bought Finecowhich marks a strong increase of 1.67%.

The steepest declines, however, occurred on ENI, which ended the session at -3.08%. Under pressure Nexi, which suffered a decline of 2.06%. He hesitates Inwit, which lost 1.43%. Basically weak MPS Bankwhich recorded a decline of 1.21%.

Between best stocks in the FTSE MidCap, UnipolSai (+10.85%), MortgagesOnline (+3.42%), Brembo (+3.27%) e Ferretti (+3.04%).

The steepest declines, however, occurred on Saint Lawrence, which closed the session at -3.06%. It slides Philogen, with a clear disadvantage of 2.90%. In red OVS, which highlights a sharp decline of 1.59%. The negative performance of MFE Awhich falls by 1.56%.