(Finance) – European markets lost momentum at the end of the session, with Milan and Paris closing just above par, after Wall Street turned down after a positive session opening. European markets had been well bought for most of the session, with investor sentiment improving after China’s central bank cut its prime rate for five-year loans by 15 basis points, beyond expectations. The spread ended the day above 203 basis points, with Italian bonds coming back under pressure due to expectations for an ECB that will do everything to bring down inflation, despite fears of a recession in the Old Continent.Weak session forEuro / US dollar, which trades with a decline of 0.30%. L’Gold it is essentially stable at $ 1,840.7 per ounce. Oil (Light Sweet Crude Oil) shows a timid gain and marks a + 0.59%.

Uphill it spreadwhich reaches +203 basis points, with an increase of 8 basis points, with the yield of the ten-year BTP equal to 2.97%.

Among the main European stock exchanges definitely positive balance for Frankfurtwhich boasts a progress of 0.72%, good performance for Londonwhich grew by 1.19%, and without ideas Pariswhich does not show significant changes in prices.

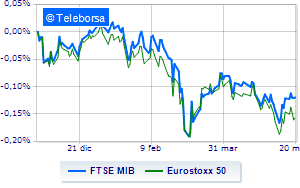

No significant change in closing for the Milanese list, with the FTSE MIB which stands at 24,095 points on the eve of the event; on the same line, remains around the parity line FTSE Italia All-Sharewhich closed the day at 26,286 points.

Slightly negative the FTSE Italia Mid Cap (-0.31%); on the levels of the eve on FTSE Italia Star (-0.15%).

At the close of Milan it appears that the countervalue trading in today’s session amounted to € 2.55 billion, an increase of 19.59%, compared to the previous € 2.13 billion; while the volumes traded went from 0.52 billion shares of the previous session to today’s 0.55 billion.

Against the 442 shares traded, purchase requests were received for 243 shares. In letter instead 192 titles. The remaining 7 stocks are almost stable.

Among the best Blue Chips of Piazza Affari, stands out Nexi which marks an important progress of 4.45%.

Fly Inwitwith a marked increase of 3.69%.

It shines Is in thewith a strong increase (+ 3.15%).

Excellent performance for Recordatiwhich records a progress of 2.53%.

The strongest declines, on the other hand, occurred on CNH Industrialwhich closed the session at -6.25%.

Collapses Saipemwith a decrease of 4.00%.

Sales focus on Monclerwhich suffers a 1.95% decline.

Sales on Finecowhich recorded a decline of 1.72%.

Between best stocks in the FTSE MidCap, Bff Bank (+ 2.83%), Intercos (+ 2.25%), Cattolica Assicurazioni (+ 2.25%) e Mfe B (+ 1.91%).

The worst performances, however, were recorded on Carel Industrieswhich closed at -4.13%.

Sales hands on Technogymwhich suffers a decrease of 3.75%.

Bad performance for Saint Lawrencewhich recorded a decline of 3.39%.

Black session for Tod’swhich leaves a loss of 2.74% on the table.

Between macroeconomic variables heavier:

Friday 20/05/2022

half past one Japan: Consumption prices, annual (previous 1.2%)

08:00 Germany: Production prices, annual (expected 31.5%; previous 30.9%)

08:00 Germany: Production prices, monthly (expected 1.4%; previous 4.9%)

08:00 United Kingdom: Retail sales, monthly (expected -0.2%; previous -1.2%)

08:00 United Kingdom: Retail sales, annual (expected -7.2%; previous 1.3%).