(Finance) – The main stock exchanges of the Old Continent and Piazza Affari were all positivewhich continues to rise, pending the launch of Wall Street and on the eve of the Fed’s decisionsfrom which another rate hike of 75 basis points is expected.

Signals of one are expected from the FOMC pause in the cycle of rate hikesthough Goldman Sachs estimated that the peak will be reached around 5%. Meanwhile, ECB President Christine Lagarde has signaled that inflation may have peaked and that rate hikes will ensure that it returns to the 2% target over the medium term.

The data of the US PMI and ISMafter the Chinese PMI it recovered from lows but remained below the key 50 point threshold.

L’Euro / US dollar shows a timid gain, with a progress of 0.51%. Advancegold, which trades at $ 1,655.8 an ounce. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 1.52%.

Stable it spreadwhich stops at +211 basis points, with the yield of the 10-year BTP standing at 4.16%.

Among the European lists positive balance for Frankfurtwhich boasts a progress of 1.30%, in light Londonwith a large increase of 1.48%, and a positive trend for Pariswhich is up by a decent + 1.63%.

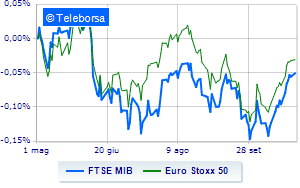

Strong upside exchanges for the Milan stock exchange, with the FTSE MIB, which is posting a 1.72% gain; along the same lines, the FTSE Italia All-Sharewhich with its + 1.66% advances to 24,994 points.

Salt on FTSE Italia Mid Cap (+ 1.17%); on the same line, positive the FTSE Italia Star (+ 1.22%).

Between best Italian stocks large-cap, exploit of Telecom Italiawhich shows an increase of 3.84%.

Well bought Campariwhich marks a sharp rise of 3.25%.

Fineco advances by 2.49%.

It moves into positive territory Amplifonshowing an increase of 2.47%.

At the top among Italian stocks a mid cap, De Nora Industries (+ 3.01%), Ferragamo (+ 2.82%), Illimity Bank (+ 2.62%) e Maire Tecnimont (+ 2.55%).

The strongest falls, on the other hand, occur on Secowhich continues the session with -1.05%.

It moves below par Saint Lawrenceshowing a decrease of 0.77%.