(Finance) – The stock is under pressure PepsiCo which trades with a loss of 2.91%.

The group recorded a decline in revenues by 0.5% to 27.85 billion, against the consensus of 28.4 billion, mainly due to declining demand in North America. Earnings per share, however, exceeded estimates: EPS amounted to $1.78 versus the expected $1.72.

In the fourth quarter, profit was $1.3 billion, 94 cents per share, up from $518 million (37 cents per share) a year earlier.

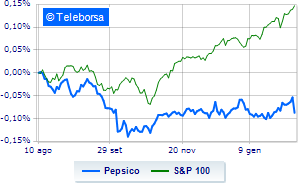

The weekly analysis of the stock compared toS&P 100 shows a lag behind the index in terms of the relative strength of the food and beverage companywhich performs worse than the reference market.

The short-term implications of PepsiCo they underline the evolution of the positive phase at the test of the USD 171.1 resistance area. A descent to the bottom 166.7 is possible. A strengthening of the curve is expected upon testing new targets of 175.6.