(Finance) – The performance of Pepsicum which trades with a percentage change of 1.15%.

The improvement in the evaluation by Bernstein’s analysts contributes to assisting the shares: the opinion on the shares of the beverage giant has been brought to “market-perform”.

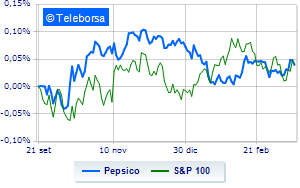

The trend of pepsico, shows a trend in line with that ofS&P 100. This situation classifies the security as a low alpha value asset that does not generate any added value, in terms of return compared to the reference index.

The short-term technical framework of pepsico, shows an upward acceleration of the curve with a target identified at 177.9 USD. Risk of a fall to 175.9 which will not affect the good health of the current trend but which represents a temporary correction. Expectations are for an extension of the uptrendline towards 180.