Anticipating your retirement by purchasing real estate is far from a new idea. It remains to choose between the different solutions, taking into account the tax consequences, which weigh heavily in the equation.

Invest directly in real estate by favoring furnished accommodation

In the ideal configuration, the saver buys a property on credit to rent it out. The rents collected are used to pay part of the monthly loan payments. Once retired and the loan has been fully repaid, the owner benefits from additional financial support. The idea is good on paper, but its profitability is low, particularly due to taxation: property income net of deductible charges is taxed at the progressive scale of income tax, with social security contributions of 17.2%. “A taxpayer taxed in the marginal 30% bracket sees almost half of his property income disappear,” notes Guillaume Eyssette, founder of the independent wealth management firm Gefinéo. The operation therefore appears not very lucrative, especially since the rents are capped in many municipalities.” We can certainly hope to realize a capital gain on the property, failing to obtain an advantageous return, but it remains risky to base our future retirement on the hypothetical increase in real estate prices over the next fifteen or twenty years. years.

The other solution, which savers also choose, consists of buying a property to rent it furnished. The non-professional furnished rental regime (LMNP) responds perfectly to the tax issue: income (rent) is declared as industrial and commercial profits (BIC), from which the lessor can deduct a fraction of the purchase price of the property in the form of depreciation. “In practice, this translates into almost no taxation during the first twelve to fifteen years, because the rents are offset by depreciation,” summarizes Guillaume Eyssette. A very advantageous system… at least in the current state of the regulations: the finance bill for 2025 in fact proposes to reintegrate the depreciation of the property into the calculation of the capital gain upon resale. For the moment, nothing has yet been done, because it is above all short-term rental that is in the viewfinder. To be continued.

© / THE EXPRESS

Opting for bare ownership, a solution to anticipate

Build real estate assets while benefiting from a discount on the purchase price, optimizing taxation and without the stress of daily rental management: this is the promise of bare ownership investment. This involves buying a property in dismemberment: the investor acquires bare ownership, while the usufruct goes to a professional lessor. “The buyer benefits from a discount of 30 to 40% of the price of the property in full ownership,” explains Nicolas de Bucy, general manager of Perl, a company specializing in this type of arrangement carried out with social landlords. Throughout the duration of the dismemberment, fixed at between fifteen and twenty years, the social landlord is responsible for renting the property and collects the rent. The owner of the bare property therefore does not receive any property income, which, logically, does not generate taxation.

The property is also not included in the basis of the real estate wealth tax (IFI) for the taxpayers concerned. The icing on the cake: “If he finances the operation on credit, the interest on the loan is deducted from his other property income when the usufructuary is a social landlord,” specifies Nicolas de Bucy. The ideal is to anticipate by investing before the age of fifty in order to regain full ownership of the property a little before retirement. It will then become possible to rent it out to collect rents. Another solution is to resell and then place the capital obtained in a life insurance contract, preferably opened eight years previously in order to be able to make low-tax withdrawals as and when needed. This type of program requires an investment of between 100,000 euros and 200,000 euros in most cases.

Diversify your assets with SCPI shares

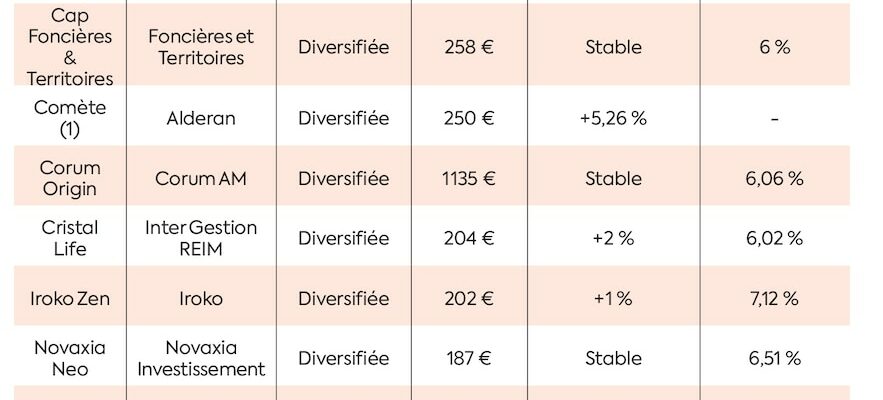

Invest in a hundred real estate assets with an initial investment of a few hundred euros? This is possible thanks to real estate investment companies (SCPI), these financial investments holding professional physical real estate (offices, businesses, warehouses, etc.). These products pay a regular income, the amount of which is directly linked to the rent collected. It is therefore an ideal solution to supplement your income during retirement, with an average return of 4.52% in 2023, according to the French Association of Real Estate Investment Companies (Aspim). But SCPIs have been going through a crisis for eighteen months. The sharp rise in interest rates between 2022 and 2023 has led to a drop in the valuation of buildings. The rise of teleworking has also shaken up the office market, with remote premises now being neglected. As a result, the value of SCPI shares fell by an average of 10.3% in 2023. Other declines have occurred since the start of the year. “We will still have adjustments until the end of 2024, but the situation will improve in 2025 in a context of reduction in the key rates of the European Central Bank”, analyzes Jonathan Dhiver, the founder of the broker BestSCPI. com. The yield of SCPIs should remain stable in 2024 at around 4.5%.

In this context, you should not completely rule out the product, but be cautious. Thus, it is recommended to invest in several SCPIs to spread the risk, by diversifying across several management companies, and by varying the geographic areas and types of investment. If some vehicles are suffering, others see the current situation in a positive light. “SCPIs having collected in recent months will be able to seize market opportunities by investing their cash in buildings at attractive yield levels given the fall in prices,” adds Jonathan Dhiver.

On the tax side, property income from rents collected by SCPIs is subject to the income tax scale and social security contributions. In addition, SCPIs are included in the assets taxable by the IFI. To reduce the tax burden, it remains possible to invest through life insurance in order to benefit from the taxation of this envelope. But the choice is then restricted to the handful of supports generally referenced by the insurer. Another option: buy SCPI shares in bare ownership to obtain a discount on the purchase price. In this case, the saver only receives the income at the end of the dismemberment, once upon retirement, when his marginal tax rate is traditionally lower.

Buy a life annuity with a discount

“Buying a life annuity property allows you to build up real estate assets at a lower cost, since the property is sold at a discount to take into account its occupation by the seller,” indicates Igal Natan, associate director of the Renée Costes group. The level of this discount depends on the life expectancy of the seller, which results from their age and gender. For example, it reaches 43% if the seller is a 75-year-old man, and 49% if it is a woman of the same age. The occupied value of a property estimated at 300,000 euros is thus between 153,000 and 171,000 euros in our example.

The buyer pays part of this amount on the day of the sale (this is the bouquet), and the balance in the form of a life annuity. This amounts on average to 738 euros according to Renée Costes, for an average bouquet of 76,000 euros. The buyer can also sometimes pay this amount in one go, on the day of the sale, by purchasing bare ownership of the property. In both cases, he will recover full ownership upon the death of the seller, and will then be able to carry out work to rent it out and receive income, or sell it to obtain capital from which to draw to supplement his retirement. “The objective is to make your investment horizon coincide with your retirement date, and therefore to choose a seller who is around 75 years old when you buy a life annuity at 50,” recommends Igal Natan. While keeping in mind that there remains uncertainty as to the actual release date of the property.

.