Investing on the stock market via funds has the advantage of not having to worry about the selection of securities and sometimes even the savings allowance between the various markets. To be efficient over time, a portfolio is not decided in terms of a year financial forecasts, but with a long -term perspective with, as a priority, good diversification. This is why we have selected different supports to expose themselves to both the United States and to emerging markets or to French actions. These investments can take place via actively managed funds or by ETF (Exchange Traded Funds), also called listed index funds. The latter reply a stock market index and are particularly well suited to expose themselves to lower cost to very wide markets.

This approach does not prevent some tactical adjustments according to the orientation of the markets. You will thus find in the selection below a vehicle of small and average American capitalizations to take advantage of the extension of the stock market performance of the S&P 500 to the whole coast, or a bond fund High yield To take advantage of the attractive porting currently offered by these titles. Investors preferring turnkey solutions will turn to our selection of diversified funds.

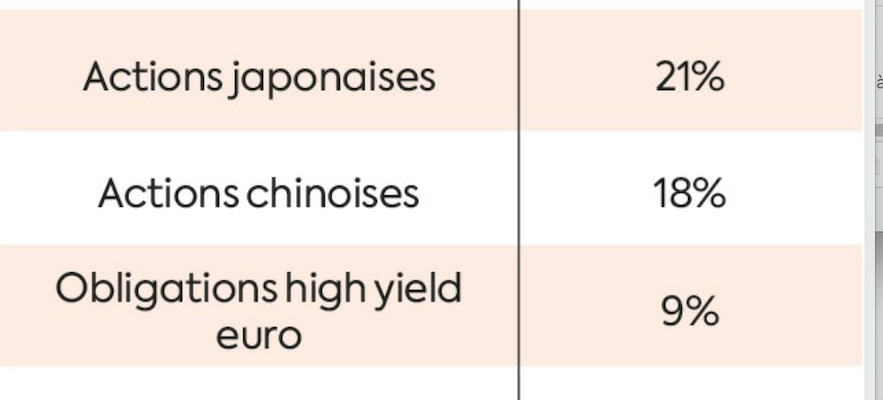

3842 CT Placements Preferes Funds

© / 3842 CT Placements Preferes Funds

Jpmorgan US Select Equity Plus

This manager of the JP Morgan Asset Management manager makes it possible to take advantage of the growth of the United States via large American values. The selection of titles is carried out after a careful analysis of their fundamental qualities and their potential for future profits. The team can also sell in the open securities deemed to be not very attractive to benefit from the drop in their course, for around 30 % of the net assets. The manager at the controls of the fund, Susan Bao, has been piloting the strategy for seventeen years, with a very convincing performance history: more than 14 % gain per year on average over the last decade.

Ishares Core S & P500 UCITS ETF USD

To invest in the New York Stock Exchange, the choice of supports is vast. We favor physical replication ETFs – those who actually hold the titles making up the replicated – and large index.

A real juggernaut on the side, the Ishares Core S & P500 UCITS ETD USD, managed by Ishares (BlackRock), weighs more than $ 100 billion. It faithfully moderates the S&P 500 index worded in dollars, which brings together the 500 largest American values. Its costs – 0.07 % per year – are minimal. There are also index funds on the NASDAQ.

Amundi Pea S&P 500 Ucits Etf

Here is another solution to take advantage of the good performance of the markets across the Atlantic. This ETF of Amundi replies the S&P 500 while being eligible for the equity savings plan (PEA), usually circumscribed to European actions. To carry out this tour de force, the manager holds in the portfolio of European values whose value he discusses for that of the securities making up the S&P 500. This fund therefore offers international diversification to PEA holders, at a lower cost (0.12 %).

BNP Paribas Funds Sicav Us Small Caps Classic

After the outbreak of a handful of large capitalizations last year, stock market growth could be better distributed in the US scholarship. “You have to start taking your profits on the” seven magnificent ” [NDLR : Alphabet, Amazon, Meta, Apple, Microsoft, Nvidia et Tesla] And reposition yourself on the rest of the rating, “recommends Laurent Denize, director of investments at Oddo BHF Asset Management. If it is possible to opt for ETF reproducing the Russell 2000, the main index of small capitalizations, this BNP Paribas Asset Management fund offers another qualitative solution. Its performance is online with those of the index.

Freedom world

Behind this catchy name, discover an international action fund managed by Dubly Transatlantique Gestion (Crédit Mutuel Alliance Federal). The fund invests in international leaders in their sector of activity, with particular attention paid to the quality of management, strategy, regularity of growth and solidity of the financial structure.

Particularity: exposure to actions is actively controlled: this can evolve between 60 and 100 % of the portfolio. In ten years, the sums placed have been multiplied by three.

Groupama Global Active Equity

Aiming to beat the reference index for international actions, the MSCI World, this fund managed by Groupama Asset Management selects business actions deemed creative of value by identifying long -term bearing trends. This work is accompanied by an analysis on environmental, social and governance criteria. Its long -term performance is very honorable with an increase of 83 % over five years and a capital multiplied by three in ten years.

Ishares MSCI World Swap Pea Ucits Etf

There is a large amount of ETF to replicate the MSCI World index. These supports make it possible, in a single line, to expose themselves to the 1,500 values from the 23 developed countries which compose it. Note however that this index grants a large place to American actions (almost three-quarters of total capitalization). Among the various offers, this Indication fund of Ishares (BlackRock) is distinguished by its eligibility for the equity savings plan (PEA). Launched last March, it displays annual management fees of 0.25 % and a very accessible share price of 5.75 euros.

Dresso Qi Emerging Markets Sustainable Active Equities

This dressco product provides access to emerging markets (China, Taiwan, South Korea, India, Brazil, Saudi Arabia, South Africa, etc.) and to take advantage of their growth potential. Particularity: it uses a quantitative model to select its titles, based on several factors and classifying actions according to their relative future performance. It favors titles whose environmental imprint is relatively low.

This area experienced two difficult years, in 2020 and 2022, so that, over five years, the performance reached only 27 %. On the other hand, the increase of 2024 was greater than 20 %.

M&G (Lux) Pan European Sustain Paris Aligned Fund

With a portfolio concentrated on around thirty titles, this fund from the British house M&G Investments favors a small number of companies that the team knows well and which it keeps over time. Companies with a sustainable business model but faced with short -term difficulties, which makes their title interesting. Another peculiarity: since 2021, the fund has been aligned with the Paris Agreement, which plans to limit global warming. In practice, the team ensures that the companies chosen will reduce their greenhouse gas emissions, with encrypted objectives.

Eleva European Selection

This fund of the young management company Eleva Capital selects European actions based on four themes: companies held by families or foundations; Innovative economic models in mature activity sectors; management or shareholding changes; Divergent valuations between bond markets and shares. Managers seek to beat the Stoxx Europe 600 index, made up of the 600 main European stock market capitalizations. Bet held. With ten years of existence, the fund has an increase of 79 %, versus 68 % for the Stoxx 600.

EDR SICAV Tricolore Convictions

Former portfolio star under the tricolor name, this fund of the management company Edmond de Rothschild Asset Management had a facelift with the arrival of a new team three years ago. The product has been refocused on French actions and its portfolio focused on around forty solid values, without a predetermined management style. It gives pride of place to small and medium -sized capitalizations, growing niche players and weakly valued companies with competitive advantages, in order to benefit from a better feeling on the French market.

Despite the stock market slump on the hexagonal market last year, the fund posted a slightly positive performance by almost 4 %.

Dynamic growth CPR

As its name suggests, this vehicle is intended for profiles wishing to expose themselves in the majority of actions. The portfolio is indeed made up of 50 % to 100 %, the balance being distributed in the bond markets, monetary, raw materials or other. The allocation work is carried out on an international perimeter. The investment is then made via ETF. Supervised by Malik Haddouk, the boss of the diversified management of CPR Asset Management, this fund has a solid performance history. Between 2020 and 2024, the average performance was 8.24 % per year.

BGF Global Allocation Fund

This diversified product from BlackRock allows balanced exhibition to international markets. Its objective: to reduce the risk of the equity market by one third party. Very exposed to the New York Stock Exchange, it currently promotes shares, which represent 66 % of the outstanding. Since its creation, in 1997, annualized performance has reached 5.50 % and it ranks regularly among the most efficient in its category.

Keren Heritage

This support will suit savers with a more prudent profile. Indeed, he cannot invest more than 35 % of his assets in equity (31 % at the end of December 2024) while the obligations can represent to the entire portfolio if the market environment justifies.

On the geographical level, French titles are favored with diversification in the euro zone. Managed by Keren Finance, an independent shop created in 2001, this product recorded a cumulative performance of almost 39 % over ten years.

Sycoyield 2030

By investing with a predefined time horizon in debt securities reimbursed on a date fixed in advance, the due funds have appreciated visibility of savers. The drop in interest rates has reduced the offer, but some launches have nevertheless been operated in recent months, so this product from Sycomore Asset Management. The portfolio, diversified on more than 100 lines, has Euro bonds issued by high -performance companies. With the titles in which he invested, the fund joined at the end of December 2024 a gross return of 5 %.

Carmignac Portfolio Credit

Flexible, opportunistic and multistrategies. This carmignac management vehicle can seek the performance of the bond markets wherever it is, depending on the convictions of the managers. It also uses CDS (Credit Default Swaps), financial contracts to cover yourself against the defect of a transmitter. Welcome flexibility in a bond world full of uncertainties, where the markets move very quickly. In 2024, it increased by more than 8 % and benefited at the beginning of 2025 from the high performance of the titles in the portfolio.

Schelcher Euro High Yield

Managed by the specialized company Schelcher Prince Management (Arkéa Asset Management entity), this fund selects high -end and high yield bonds. The managers’ convictions guide the portfolio allocation: in 2024, the latter thus largely overwhelmed the financial sector, a buoyant bet since the support won more than 9 % in the past year. The risk remains nevertheless controlled and the SRI (Synthetic Risk indicator) is set at 2 on a scale ranging from 1 to 7.

An article in the special file “Placements: our 40 advice for 2025”, published in the Express of February 20.