67.5 billion euros. It is the cumulative amount of dividends paid to shareholders in 2023 by listed companies belonging to the CAC 40 index. A sum permitted by their financial results for the year 2022. A “prize” far from being negligible since it represents 48% of the cumulative profits in 2022. This is the reason why the dividend will contribute, just like the stock price, to the overall financial performance of a share and its attractiveness.

When a company is profitable, it generates profits, which will be mobilized to meet different objectives. Above all, it can use this sum for its own account, by investing in equipment, processes, research and development or making acquisitions. This option is favored by so-called “growth” companies, as is the case for a large majority of technological players. It can also repay part of its loans early in order to reduce its debt and improve its financial strength. It can also decide to benefit its employees, by redistributing part in the form of salary increases or bonuses. It can also place these profits in short to medium term financial instruments (monetary, bond) to keep them on hand. Finally, it can reward its shareholders by paying them a dividend. Generally, companies combine these different possibilities, prioritizing priorities according to their strategic interests.

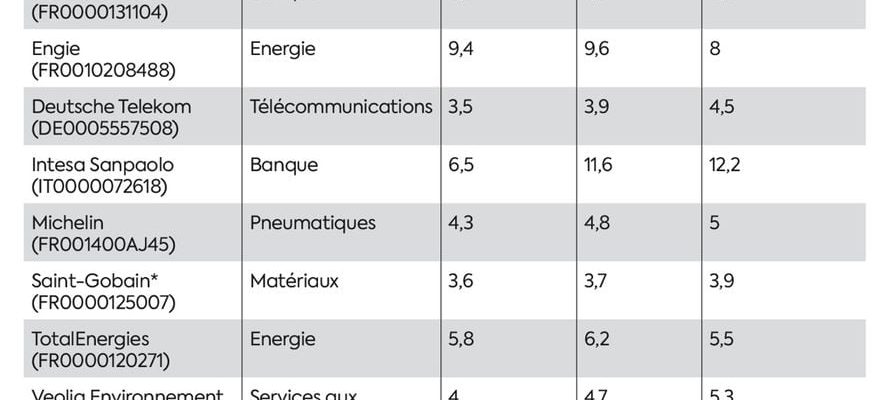

In a report published last August, asset manager Janus Henderson analyzes the amount and evolution of dividends distributed globally by the largest multinationals. According to this study, they “reached the record figure of $568.1 billion in the second quarter of 2023, an overall increase of 4.9% compared to the second quarter of 2022”. With an increase of 9.7% over one year, it is the European groups (excluding the United Kingdom) which posted the strongest increase over this period, ahead of Japan (+ 6%), Asia excluding Japan (+ 4 .5%) and North America (+ 4.2%). In this class, the major French companies play the very good students. Their share represents 30% of the amounts paid in Europe, ranking them ahead of German firms. “In France, distributions increased by 10.3% over one year, underlines the study. The energy company Engie is the main contributor, increasing its dividend by two thirds thanks to the explosion in its profits, against a backdrop of an increase energy prices.”

10 values

© / DR

A strong signal sent to shareholders

How can we explain this desire to reward shareholders? Several reasons favor this trend. “A company that pays a dividend sends a strong signal to its shareholders in the sense that it demonstrates that its activity is profitable and generates sufficient liquidity to allow it not only to invest, but also to reward them financially,” notes Franklin Pichard, Managing Director at Kiplink Finance. It is also a way to attract new investors and retain them over the long term in order to obtain a stable base in terms of the distribution of one’s capital. Which can be a good weapon to both to limit the volatility of its stock price and to better cope with a hostile purchase offer from a competitor.”

For investors with a wealth perspective, wishing to keep their securities for several years, the choice of integrating into their portfolio a dose of these so-called yield stocks, regularly granting juicy dividends, makes perfect sense. Professional managers do not ignore this subject. “Before investing in a stock, we carefully look at four major components,” explains Bastien Guillaud, manager at Matignon Finances. “This involves both identifying the capacity of a group to create growth, and determining its financial solidity by analyzing in particular its debt ratio and its cash generation, to evaluate its level of valuation, to know whether it is expensive or not, and finally to assess the returns it displays via the payment of ‘a dividend and the repurchase of shares.’

Good long-term performance

Because, even if equity investments can offer good performance in the long term, they still remain risky. The increase in a company’s results and, thereby, the progression of its share price, depends on a multitude of external factors – such as the quality of the economic environment – and internal: its financial solidity, the relevance of its development strategy or even competitive intensity. Result: at any moment, a grain of sand can seize the mechanism, affect its performance and cause its stock price to fall. By selecting a few yield values, you benefit from a sort of insurance which offers, beyond the evolution of the latter, a financial “bonus” distributed regularly. This is most of the time paid in cash. Some companies also offer settlement in shares.

To calculate the return on a stock, simply divide the amount paid for each security by its price, then multiply the total by 100 to obtain a percentage. So, let’s take the example of Engie which granted a dividend of 1.40 euros in May 2023 for a stock price of 14.50 euros: its yield amounts to 9.7%.

“But be careful, you should not systematically choose the groups which offer the highest returns, warns Franklin Pichard. You must ensure that these are well linked to a real corporate culture recurring over the years and check that they are not the result of a significant drop in their stock price.” It is therefore relevant to study the regularity of the granting of dividends for a stock market value over past years to see if it meets these criteria or if it is a temporary phenomenon.

Performance can also be improved if the company carries out share buyback programs. During this operation, it mobilizes part of its liquidity to acquire its own securities on the stock market which it will then destroy, which leads to a drop in its capital. Fewer shares in circulation also mean, for the same amount distributed, an increasing amount per share, therefore a higher return. TotalEnergies, for example, is very active in this area. The group specified, at the end of September, that it intended to carry out a vast share buyback program in 2023, amounting to 8.5 billion euros. Result, if the yield calculated on the “pure dividend” is 6.2%, it exceeds 10% including this operation.

The profile of companies that pay good dividends, regular over time, is quite targeted. These are essentially “mature” companies, already well industrialized and equipped, established in their markets and which have an activity that is sometimes cyclical but very profitable, allowing them to generate robust profits without being obliged to mobilize heavy investments. They generally have a strong balance sheet with little debt.

The banking sector far ahead of others

In addition, the Janus Henderson report highlights the most generous sectors: banking comes far ahead of the others with 152 billion dollars distributed globally, ahead of consumer goods (94.5 billion dollars), industry (49.5 billion) and oil and energy producers (41.6 billion). In France, “these companies are positioned in the banking sector, like BNP Paribas, and insurance, with Axa, analyzes Olivier Cornuot, director of collective management at Matignon Finances. In energy, TotalEnergies is a factory to cash, making significant profits as long as the barrel of oil is above $50. Let us also mention the energy company Engie, a major player which offers good visibility as to the progression of its results.”

Visibility is indeed the objective sought when putting a dose of return in your portfolio. This is opting for reason. Indeed, these companies are not always the stuff of dreams, because they do not necessarily offer double-digit growth, but they are solid and profitable over time.

.