“No hay plata” – there is no money. In December 2023, at the bottom of the steps of Congress, the new Argentine president is lucid about the state of the country he inherits. There is no question of making detours of language for someone who presents himself as an economist before being a politician. After several decades of Peronism [NDLR : mouvement politique inspiré par Juan Perón]Argentina is eaten away by chronic inflation, undermined by a gigantic debt and shunned by international investors. However, the scale of the project does not make Javier Milei, a follower of “anarcho-capitalism”, dizzy, who is convinced of the path to take: “there is no alternative to shock”, insists -he. The tone of his policy is set: it will be aggressive and without concessions.

Almost a year after taking his place at the Casa Rosada, the headquarters of the Argentine executive, the president benefits from a support rate which fluctuates between 45 and 50%. Remarkable score for the one who swallowed a bitter potion of reforms whose consequences have, in the short term, weakened the country.

Put out the fire

From the first day of his mandate, Javier Milei’s priority is to dry up the budget deficit. And, if necessary, using his favorite tool: the chainsaw. “The Argentine political system has become accustomed to excess spending. Under Cristina Kirchner, it soared to 45% of GDP,” Emilio Ocampo, Milei’s former economic advisor, laments to L’Express. “The country was stuck in a spiral where the Central Bank was printing money to finance the deficit, which was causing inflation to rise.” To put out the fiscal fire, Milei is activating all the levers: reduction in the number of ministries, reduction in subsidies, contraction of transfers to the provinces. An unprecedented adjustment, both in terms of its speed and its scale.

The drastic cuts do not take long to bear fruit: from the first quarter of 2024, the country records a budget surplus. A first since 2008, Milei welcomed in April, announcing to Argentines “that more than half the road has been covered”. The dynamic continued in the following months, under the satisfied eye of the International Monetary Fund (IMF), with which the country has not always maintained peaceful relations. Furthermore, the trade balance is improving and the official and informal exchange rates between the peso and the dollar are converging. “We were very surprised to see how much Milei was able to do, being a political outsider and without strong support in Congress,” says Todd Martinez, co-head of sovereign ratings for the Americas at the Fitch rating agency.

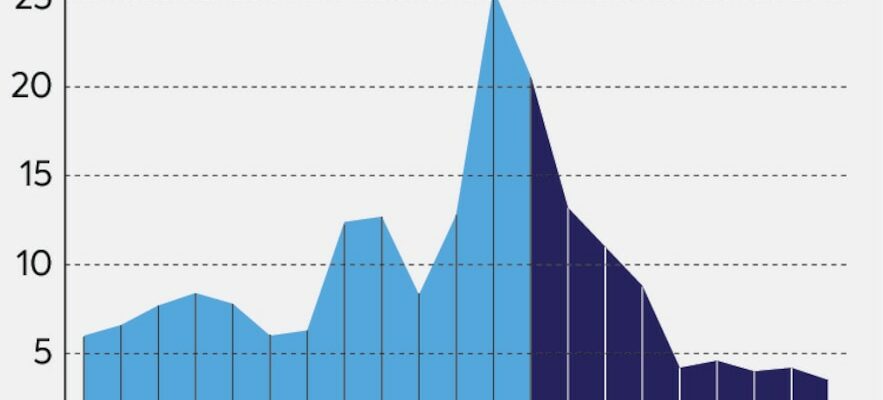

But the government’s greatest feat is to have brought down inflation. Beyond 25% in December, the monthly rate fell below 4% in September. “Society was ready to make significant sacrifices, particularly in terms of quality of life, to try to resolve the problem of inflation which was getting worse,” recalls Martin Kalos, director of the consulting firm EPyCA Consultores.

3827-INFOG-COMMERCE-2

© / The Express

The poverty rate has risen to 53%

Despite this progress, thousands of Argentines have been hitting the streets in Buenos Aires for several months, brandishing signs reading “Hunger does not wait” or “No to adjustment”. Because this policy has a price: the poverty rate rose to 53% in the first half of 2024, compared to 40% a year earlier, and almost two thirds of 15-29 year olds now live below the poverty line. Their purchasing power has suffered in particular from the removal of subsidies on energy, water and transport. And to further reduce public spending, the president also attacked pensions and the university budget. “For the moment, the company is holding up, but we don’t know for how much longer,” worries Martin Kalos.

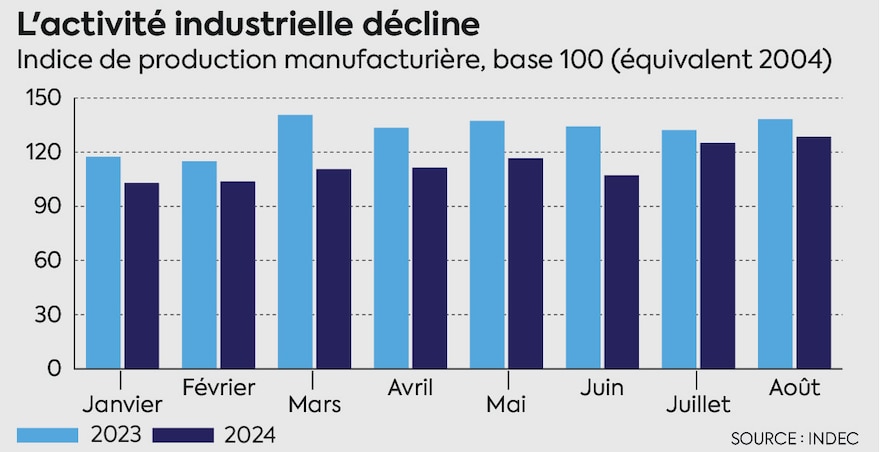

The country is sinking into recession. With the exception of agriculture and energy, many sectors have seen their activity decline: the construction sector has plunged by 30% in one year due to the cessation of public works ordered by the president. “In fact, Milei succeeded in bringing down inflation by curbing demand and activity,” summarizes Bruno De Moura Fernandes, head of macroeconomic research at Coface.

3827-INFOG-COMMERCE-3

© / The Express

However, these consequences were well anticipated by the Argentine president. In December, he warned that his fiscal shock would have a negative impact on activity levels, employment and poverty – “a difficult step, which would be followed by a light at the end of the road”. And some positive signals are already visible: real wages in the private sector have increased by 10% since December 2023, notes Luca Moneta, senior economist at Allianz Trade, while the reactivation of private credit is helping to recover activity.

From words to actions

Proclaimed in fiery speeches, Milei’s campaign promises have not all been kept. The plan to “dollarize” the economy was ultimately rejected. To the great dismay of Emilio Ocampo: “Argentines already use the dollar more than the peso. The problem is that liquidity is kept outside the banking system and therefore does not contribute to growth”, argues the former advisor to the president , who preferred to resign shortly after the election, believing that he “was no longer the right person to lead the Central Bank if dollarization was not officially planned.”

More broadly, many point to the lack of clarity in monetary policy. Contrary to his statements in October 2023, when he compared the peso to “excrement”, the Argentine president now seems to want to encourage confidence in the national currency. As for the closure of the Central Bank – mentioned during the campaign – it did not take place.

The real challenge remains the end of exchange controls, which prevent foreign companies from repatriating their earnings in dollars to their country. “It seems surprising to us that Milei is so comfortable maintaining this policy that is far from liberal,” says Todd Martinez. For its part, the Central Bank is exploring all options to increase its dollar reserves. The tax amnesty law, which exempted deposits of less than $100,000 from taxes, prompted many Argentines to take their greenbacks out from under their mattresses. “This law shows that the government is prepared to do what it takes to remove exchange controls. Dollar deposits have increased by around 12 billion in recent months, more than Argentina owes to IMF for its debt in 2025”, observes Luca Moneta.

Cautious optimism

Despite the determination of the Milei government, the transformation of the country is taking place slowly. In Parliament, the presidential party, La Libertad Avanza, does not have a majority. The results of the next elections in 2025, then 2027, will be crucial. “The big question is who will come after Milei. If it is a government that increases public spending again, all these efforts will have been in vain,” warns Juan Luis Bour, chief economist at the Fiel think tank. Until then, “cautious optimism” reigns in business circles, observes Martín Simonetta, professor of economics at the Universidad de Ciencias Empresariales. “International investors are waiting to see if Milei will succeed in freeing exchange controls or if the country will plunge back into yet another crisis,” explains Bruno De Moura Fernandes.

In the meantime, Argentina has been negotiating a new aid package with the IMF for several months. After an expected recession this year, the institution is counting on a jump of 5% in 2025. Who knows, perhaps the light at the end of the tunnel promised by Milei?

.