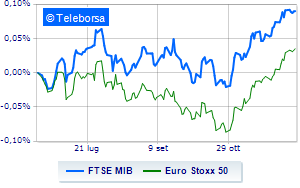

(Finance) – Mixed ending for the main European markets, with investors continuing to evaluate the outcome of the Fed and ECB meetings, looking at when central banks could start cutting rates for the first time (despite some signs of caution expressed by Powell and Lagarde who have repeatedly repeated that the next choices will depend on the data).

On the macroeconomic front, data from the December PMI survey (conducted by Hamburg Commercial Bank and S&P Global) indicate a faster contraction in economic activity in the eurozone, concluding a fourth quarter in which production fell at the fastest rate rapid in 11 years, excluding the first pandemic months of 2020.

Negative session forEuro / US Dollar, which leaves, for now, 0.82% on the floor. No significant changes forgold, which trades on the day before at $2,033.9 per ounce. No significant changes for the oil market, with oil (Light Sweet Crude Oil) settling at the values of the day before at 71.43 dollars per barrel.

Consolidates the levels of the day before spreadsettling at +168 basis points, with the yield on the 10-year BTP standing at 3.70%.

Among the markets of the Old Continent remains close to parity Frankfurt. The negative performance of Londonwhich drops by 0.95%, and a positive balance for Paris, which boasts an increase of 0.28%. Piazza Affari was substantially stable, closing the session at the levels of the day before with the FTSE MIB which stops at 30,374 points; on the same line, it remains around the parity line the FTSE Italia All-Sharewhich closed the day at 32,442 points.

At the closing in Milan it appears that the value of trades in the session of 12/15/2023 was equal to 5.59 billion euros, with an increase of 37.50%, compared to the previous 4.07 billion euros; while the volumes traded went from 1.08 billion shares in the previous session to 1.31 billion.

Among the best Blue Chips of Piazza Affari, money up STMicroelectronicswhich recorded an increase of 2.74%.

Definitely positive balance sheet for Nexiwhich boasts an increase of 2.41%.

Good performance for Leonardowhich grows by 2.39%.

Supported Telecom Italiawith a decent gain of 2.36%.

The steepest declines, however, occurred on DiaSorinwhich ended the session at -5.53%.

Campari drops by 2.86%.

Decline decided for BPERwhich marks -2.2%.

Under pressure MPS Bankwith a sharp decline of 2.07%.

Among the protagonists of the FTSE MidCap, Antares Vision (+15.29%), Technoprobe (+6.83%), OVS (+5.04%) e Intercos (+4.34%).

The steepest declines, however, occurred on Brunello Cucinelliwhich ended the session at -2.84%.

He suffers Ascopiavewhich highlights a loss of 2.16%.

Prey for sellers Decemberwith a decrease of 2.13%.

They focus on sales GVSwhich suffers a drop of 1.99%.