(Finance) – Wall Street continues the session at the levels of the eve, with the stalemate on the conflict in Ukraine and the failure to turn towards a ceasefire. Meanwhile, investors look to the FOMC minutes of the latest monetary policy meeting that will be released this week.

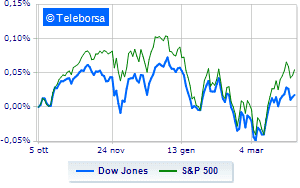

Among the US indices, the Dow Jones reports a variation of + 0.04% while, on the contrary, theS & P-500 it makes a small jump of 0.49%, reaching 4,568 points. Effervescent the Nasdaq 100 (+ 1.59%); on the same trend, theS&P 100 (+ 0.77%).

Sectors stand out in the S&P 500 basket telecommunications (+ 2.06%), secondary consumer goods (+ 1.90%) e Informatics (+ 1.41%). At the bottom of the ranking, the largest falls are manifested in the sectors utilities (-1.21%), sanitary (-0.74%) e financial (-0.65%).

Between protagonists of the Dow Jones, Salesforce.Com (+ 3.18%), Intel (+ 1.76%), Apple (+ 1.64%) e Microsoft (+ 1.27%).

The strongest falls, on the other hand, occur on Travelers Companywhich continues the session with -1.70%.

Sales on McDonald’swhich recorded a decrease of 1.43%.

Negative sitting for Procter & Gamblewhich shows a loss of 1.25%.

Under pressure Johnson & Johnsonwhich shows a drop of 1%.

To the top between tech giants of Wall Streetthey position themselves Pinduoduo Inc Spon Each Rep (+ 15.99%), Baidu (+ 8.33%), Okta (+ 8.23%) e JD.com (+ 7.18%).

The strongest falls, on the other hand, occur on Starbuckswhich continues the session with -4.39%.

It slips Modernwith a clear disadvantage of 1.73%.

In red Analog Deviceswhich shows a marked decline of 1.69%.

The negative performance of Ebaywhich falls by 1.58%.

Between macroeconomic variables most important in the North American markets:

Monday 04/04/2022

4:00 pm USA: Industry orders, monthly (expected -0.5%; previous 1.5%)

Tuesday 05/04/2022

14:30 USA: Balance of trade (expected -88.5 B $; previously -89.7 B $)

15:45 USA: Composite PMI (preceding 55.9 points)

15:45 USA: PMI services (preceding 56.5 points)

4:00 pm USA: ISM non-manufacturing (expected 58 points; precedent 56.5 points).