No need to carry your bank card with you everywhere to make your purchases. By registering it in your iPhone or Apple Watch, you can pay for everything contactless… and with no limit on the amount!

Paying for your purchases without contact has become a very commonplace gesture today. Since the Covid 21 pandemic and the application of the famous barrier gestures aimed at limiting as much as possible physical contact between individuals but also with everyday objects to avoid the spread of the virus, the vast majority of merchants have equipped themselves with TPE (Electronic Payment Terminal) boxes authorizing the use of contactless bank cards. All you have to do is present your card on the box for the payment (up to 50 euros) to be made without having to enter your confidential PIN code. However, the bank card with its small contactless payment logo on its front is not the only way to pay for your purchases with this type of box. Your smartphone can also take care of it. This is the case for iPhones and their Apple Pay system in place since 2016 in France and therefore available on fairly old iPhones (from the iPhone 6). Provided that your bank has signed an agreement with Apple, you just need to register your bank card in the iPhone to be able to pull it out instead of your card whenever it comes to paying on a POS. A system that has several advantages. First, the iPhone is not limited to a single bank card. It can accommodate several within the dedicated Cards application installed from the outset with iOS. You can therefore register your personal card, a professional card or even an American Express. You will simply have to choose the card to use when paying. Then, access to the card is secure. You will have to identify yourself with Touch ID or FaceID to validate the payment. Finally, unlike the plastic bank card nestled in your wallet, the payment made by Apple Pay contactless is not limited to 50 euros. Indeed, since the use of Apple Pay is controlled by TouchID or FaceID, this replaces the 4-digit PIN code of your bank card. There is therefore no ceiling, except for the one authorized by your card for each month. And, as a little bonus for all those who use an Apple Watch, Apple’s smartwatch, Apple Pay can also be nestled there. You won’t even need to take your iPhone out of your pocket. Simply place the Apple Watch on the TPE to pay for your purchases.

Apple Pay has long been a must for iPhone users who want to be able to pay with their devices. But the European Commission and the DMA (Digital Market Act or the regulation on digital markets in Europe) have passed by. Apple must open its iPhones to competition and allow third-party apps to exploit the device’s contactless payment system. Also, in the coming months, it is likely to see the appearance of banking or other applications that also allow you to pay for your purchases with the iPhone. In the meantime, Apple Pay remains a reliable and secure solution for contactless payments.

Which banks are compatible with Apple Pay?

Not all bank cards can be placed in the iPhone Cards application. Indeed, their registration depends on the agreements signed between the bank to which the card is attached and Apple. Nevertheless, the power and popularity of the apple company are such that partnerships are numerous. More than a hundred establishments and organizations are thus compatible with Apple Pay. Among the most popular are American Express, Banque Casino, BNP Paribas, Boursorama, Carrefour Banque, CCF, Crédit Agricole, Crédit Mutuel, Fortuneo Banque, Hello bank!, La Banque Postale, LCL, Lydia, Monabanq, Revolut and Société Générale. The complete list is available on Apple’s website.

With Apple Pay, it must be acknowledged that Apple has managed to limit complications. Adding a bank card to an iPhone takes just a few minutes.

► Open the Maps app on the iPhone. Then tap the button + at the top right of the screen.

► On the page that appears, tap Bank card.

► Apple informs you that your card usage information will be transmitted to it and communicated to its issuer. Tap Continue.

► The iPhone camera starts shooting. Lay the card you want to save to the iPhone flat and then frame it so that it fills the frame on the screen.

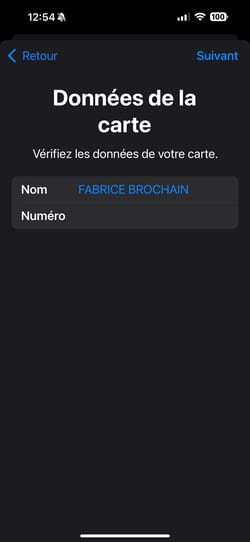

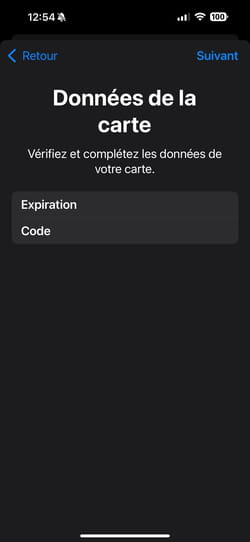

► Immediately, the information on the card is decrypted (cardholder name, card number and expiry date). Press Following.

► All that remains is to enter the validation code (made up of 3 or 4 digits depending on the type of card. This code is not the PIN code! It appears either on the front of the card or on the back. Then press Following.

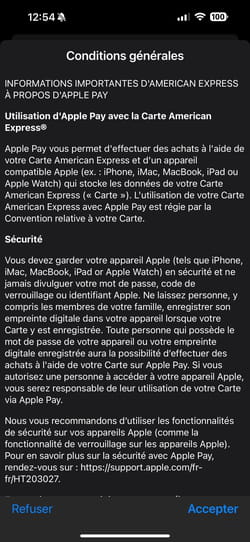

► Once this code is communicated, accept the general conditions of use.

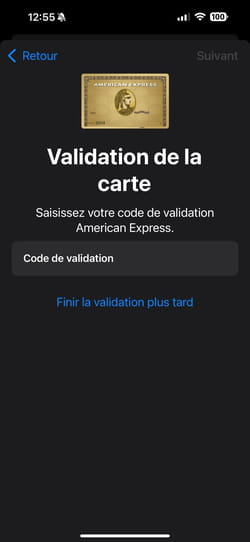

► Finally, the card issuer must validate its registration. A code should be sent to you by SMS or email depending on the communication method you have chosen. Enter the code received.

► After a few moments, your card is validated. You should also receive a message from the card issuer indicating that your card has just been registered on an iPhone.

Your card is now saved on your iPhone. Using it for your payments couldn’t be easier.

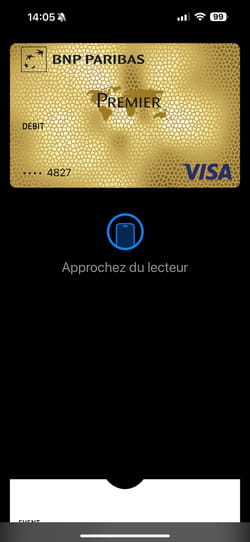

► When paying contactless, press twice quickly on the power button of the iPhone (placed on the right edge).

► The payment application is activated immediately. Identify yourself using TouchID or FaceID depending on the iPhone model you have. Once authentication is successful, all you have to do is hold your iPhone close to the TPE. The payment is validated by a small notification and by a vibration of the device. That’s it, you’ve paid.

Apple Watch owners can take contactless payment even further. Apple’s smartwatch can also be used as a means of payment. In addition, the iPhone to which the watch is connected does not need to be nearby. Payment can be made without it and even without an Internet connection. Convenient.

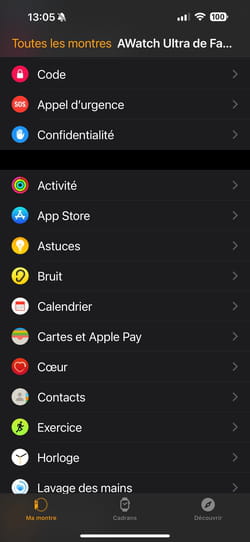

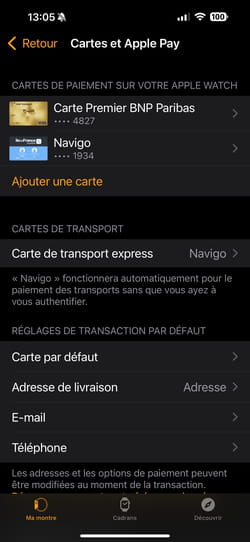

► To save a credit card to the Apple Watch, the procedure is almost similar to that described for the iPhone. First, open the Watch app on the iPhone. Tap the menu My watch bottom left then scroll down the page content and press Cards and Apple Pay.

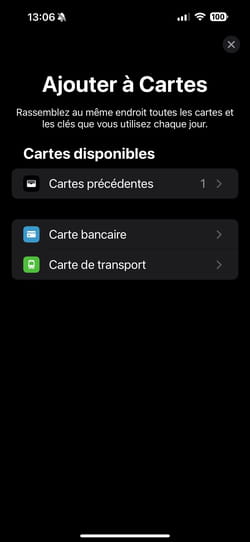

► On the page that appears, tap Add a card.

► Choose Bank card. The procedure is then identical to that described for the iPhone.

Paying for your purchases with an Apple Watch is even easier than with an iPhone. You don’t need to take the device out of your pocket since your watch is, in all likelihood, on your wrist.

► You must be wearing your Apple Watch and it must be unlocked. This is the security condition to avoid fraud. Indeed, if the Apple Watch is removed from the wrist, it locks automatically. It will not be possible to make any payment. Press twice the big side button.

► The Apple Pay app is displayed. All you have to do is hold your watch close to the TPE box to pay. A vibration accompanied by an audible notification indicates that the transaction has been successful.