(Tiper Stock Exchange) – Wall Street is weak, while investors await the quarterly reports of the banking giantsafter Friday You quote, JPMorgan And Wells Fargo have started the quarterly season. Results are expected in the coming days Goldman Sachs, Bank of America And Morgan Stanley. Meanwhile, the results of some medium-sized banksthose feared to be impacted the most by the banking stress in March. Charles Schwab recorded a quarterly performance better than expected, M&T Bank marginally beat forecasts, while State Street it disappointed analysts.

Among others corporate announcements, Merck & Co. entered into an agreement to acquire Prometheus Biosciences for approximately $10.8 billion, while Modern said the company’s experimental mRNA cancer vaccine significantly reduced the risk of death or recurrence of the deadliest skin cancer.

On the macroeconomic frontNew York’s Empire State manufacturing index turned positive, rising more than expected, and confidence in the US real estate sector improved marginally, summarized by the NAHB index.

Turning to monetary policy, several officials – including the New York Fed chairman John Williams and the Cleveland Fed chairwoman Loretta Master – they should talk later in the week. Also, on Wednesday the Fed releases the Beige Book.

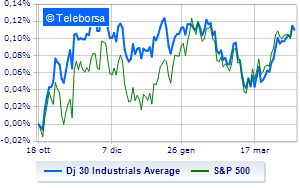

Wall Street reports a change equal to -0.1% on the Dow Joneswhile, conversely, theS&P-500, shedding 0.23%, trading at 4,128 points. Just below parity the NASDAQ 100 (-0.56%); on the same trend, under parity theS&P 100which shows a decline of 0.31%.

In the S&P 500, no fund is saved. Among the worst performers on the S&P 500 list, down the most i compartments telecommunications (-1.76%), power (-1.18%) and sanitary (-0.47%).

Among the best Blue Chips of the Dow Jones, boeing (+1.66%), Salesforce, (+0.99%), Walgreens Boots Alliance (+0.98%) and Travelers Company (+0.93%).

The strongest sales, on the other hand, show up United Health, which continues trading at -1.63%. Undertone Visa showing a filing of 1.18%. Disappointing Chevrons, which lies just below the levels of the eve. Slack IBMwhich shows a small decrease of 0.69%.

Between protagonists of the Nasdaq 100, Enphase Energy (+7.75%), Warner Bros Discovery (+3.41%), Rivian Automotive (+3.40%) and Datadog (+3.12%).

The worst performances, however, are recorded on Modern, which gets -8.50%. At a loss ASML Holding, which drops by 4.78%. Under pressure Advanced Micro Devices, which shows a drop of 3.48%. Slide alphabetwith a clear disadvantage of 3.29%.