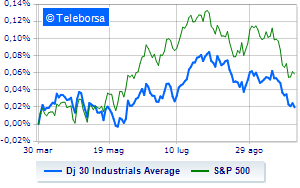

(Finance) – Positive trend for Wall Street, even if it slows down compared to the opening. No significant changes for Dow Joneswhich stands at the values of the day before at 33,632 points, while, on the contrary, theS&P-500 it proceeds in small steps, advancing to 4,309 points (+0.18%). In fractional progress the Nasdaq 100 (+0.63%); with a similar direction, just above parity theS&P 100 (+0.3%).

Positive result in the S&P 500 basket for i sectors secondary consumer goods (+1.02%), informatics (+0.91%) e materials (+0.47%). Among the worst performers on the S&P 500 list, the sectors fell the most power (-1.45%) e healthcare (-0.44%).

Investor sentiment improved after the Federal Reserve’s preferred measure of inflation rose at a slower-than-expected pace in August. According to data released by the Bureau of Economic Analysis, the core PCE price index showed a positive change of 0.1% on the month (compared to the +0.2% expected and recorded the previous month) and 3.9% on the year (+4.3% the previous month, +3.9% expected).

Last week the US central bank He kept rates in a range of 5.25% to 5.50%, but signaled that further tightening may be needed at meetings in November or December to help cool inflation. Furthermore, he indicated that the policy may have to remain at these high levels for a longer period of time than expectedan outlook that has weighed on stocks and sent bond yields soaring this week.

As regards the quarterlymixed results came in from Nikewhich ended the first quarter of its fiscal year with higher-than-expected EPS and slightly lower-than-expected revenue.

Among the best Blue Chips of the Dow Jones, Walgreens Boots Alliance (+6.46%), Nike (+5.86%), Microsoft (+1.36%) e Dow (+1.35%).

The steepest declines, however, occur at Travelers Company, which continues the session with -1.62%. Basically weak Merck, which recorded a decline of 1.34%. It moves below parity Wal-Mart, highlighting a decrease of 1.27%. Moderate contraction for McDonald’swhich suffers a decline of 1.04%.

To the top between Wall Street tech giantsthey position themselves Walgreens Boots Alliance (+6.46%), Zscaler (+4.86%), Micron Technology (+4.21%) e Datadog (+3.60%).

The worst performances, however, are recorded on Baker Hughes Company, which gets -2.56%. Decline decided for Marriott International, which marks -1.6%. Under pressure Regeneron Pharmaceuticals, with a sharp decline of 1.54%. Undertone GE Healthcare Technologies which shows a reduction of 1.44%.