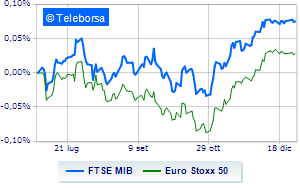

(Finance) – Slight increase for the FTSE MIBlike the main European stock exchanges, in a last session of the year without great ideas. The markets are preparing to end 2023 with a significant rise, with the EURO STOXX 50 up 17% year to date and the STOXX Europe 600 up 12% YTD.

On the macroeconomic front, Spanish inflation it fell in December 2023, also falling below analysts’ expectations (+3.1% on an annual basis vs. +3.2% in November and +3.4% estimated by the market).

L’Euro / US Dollar it is essentially stable and stops at 1.107. Substantially stable thegold, which continues the session at the levels of the day before at 2,065.4 dollars an ounce. No significant changes for the oil market, with the petrolium (Light Sweet Crude Oil) which stands at the values of the day before at 71.91 dollars per barrel.

It advances a little spreadwhich rises to +166 basis points, highlighting an increase of 2 basis points, with the yield of the 10-year BTP equal to 3.67%.

Among the markets of the Old Continent moderately positive day for Frankfurtwhich rises by a fractional +0.25%, a cautious trend for Londonwhich shows a performance of +0.14%, and session without momentum for Pariswhich reflects a moderate increase of 0.30%.

Slight increase for Milan Stock Exchangewith the FTSE MIB which rises by 0.37% to 30,443 points; along the same lines, the FTSE Italia All-Share it makes a small leap forward of 0.34%, reaching 32,574 points. Without direction the FTSE Italia Mid Cap (+0.16%); with similar direction, almost unchanged FTSE Italia Star (+0.07%).

Between best Italian shares large cap, small step forward for Record yourself, which shows a progress of 1.01%. Composed Ferrari, which grows by a modest +0.99%. Modest performance for Mediolanum Bank, which shows a moderate increase of 0.87%. Resistant ERGwhich marks a small increase of 0.77%.

The worst performances, however, are recorded on Telecom Italia, which obtains -1.84%. Thoughtful MPS Bankwith a fractional decline of 1.20%.

At the top of the mid-cap stocks ranking from Milan, Acea (+2.21%), Tinexta (+1.49%), Saras (+1.40%) e Fincantieri (+1.08%).

The steepest declines, however, occur at D’Amico, which continues the session with -1.04%. He hesitates Ariston Holding, with a modest decline of 1.03%. Slow day for Pharmanutra, which marks a decline of 0.88%. Small loss for Decemberwhich trades at -0.8%.