(Finance) – Departure in fractional decline for the Wall Street stock exchange, as expected, anticipated by the weak trend shown by the futures on the stars and stripes indices.

On investor sentiment fears of recession weigh heavily in a market that sees the prospects of monetary tightening by central banks world cup. In this regard, from the meeting of the ECB a new rate hike is expected on Thursday 27 October, as well as from the Fed in the meeting at the beginning of November.

Furthermore, the alarms from the corporate front do not help how Twitter after the Washington Post wrote that Elon Musk would have the intention, once the purchase of the social platform has been defined, to lay off 75% of the employees within a few months. Meanwhile, another social network, Snap collapses nearly 30% despite higher-than-expected earnings, due to the slowest quarterly revenue growth ever.

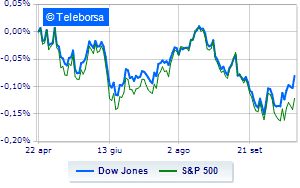

Among the US indices, the Dow Jones reports a variation of + 0.03%; on the same line, theS & P-500, with the prices reaching 3,665 points. On the levels of the eve the Nasdaq 100 (-0.15%); with a similar direction, consolidates the levels of the eve of theS&P 100 (-0.01%).

The sector is highlighted on the North American S&P 500 list power. The sector telecommunicationswith its -1.13%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, Caterpillar (+ 0.90%), Cisco Systems (+ 0.79%), Nike (+ 0.75%) e Travelers Company (+ 0.68%).

The strongest sales, on the other hand, show up on American Expresswhich continues trading at -4.26%.

Sales hands on Verizon Communicationwhich suffers a decrease of 4.21%.

In red Boeingwhich shows a marked fall of 1.09%.

It moves below par Visashowing a decrease of 0.70%.

Between best performers of the Nasdaq 100, Modern (+ 6.12%), CSX (+ 3.49%), Lam Research (+ 1.26%) e Asml Holding Nv Eur0.09 Ny Registry (+ 1.08%).

The strongest falls, on the other hand, occur on NetEasewhich continues the session with -5.20%.

Bad performance for Baiduwhich recorded a decline of 3.56%.

Black session for Datadogwhich leaves a loss of 2.41% on the table.

At a loss Meta Platformswhich falls by 2.25%.

Between macroeconomic quantities most important of the US markets:

Monday 24/10/2022

15:45 USA: Manufacturing PMI (preceding 52 points)

15:45 USA: SME services (preceding 49.3 points)

15:45 USA: Composite PMI (preceding 49.5 points)

Tuesday 25/10/2022

15:00 USA: S&P Case-Shiller, annual (previous 16.1%)

15:00 USA: FHFA house price index, monthly (previous -0.6%).