(Finance) – Difficult session for Piazza Affari, which is trading in sharp decline, in agreement with the other continental lists. Growth and inflation fears weigh on investor sentiment. Added to these are concerns that the Fed will act in a highly aggressive manner that would lead the United States into recession. From Sintra the Fed number one, Jerome Powellsaid the US economy is well positioned to withstand a tightening of monetary policy, but a “soft landing” cannot be guaranteed.

On the corporate front, outside the main list, difficult debut for the electrochemistry group De Nora which made its debut in Piazza Affari scoring a first share price of 13.40 euros, down compared to the placement price (13.5 euros) and then slipping by 3.2% to 13.06 euros.

On the currency market, weak session forEuro / US dollar, which trades with a drop of 0.41%. Sitting in fractional reduction for thegold, which for now leaves 0.30% on the parterre. Oil (Light Sweet Crude Oil) continued the session just below par with a negative change of 0.71%.

Unchanged it spreadwhich stands at +189 basis points, with the yield on the ten-year BTP standing at 3.30%.

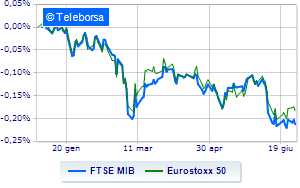

Among the European lists breathless Frankfurtwhich retreats by 2.77%, thud of Londonwhich shows a fall of 1.90%, and letter up Paris, which records a significant decrease of 2.78%. Piazza Affari, with the FTSE MIB which accuses a decrease of 2.69%; along the same lines, the FTSE Italia All-Share it collapsed by 2.66%, down to 23.242 points.

Between best Italian stocks large-cap, good insights into utilities such as Snam, which shows a large lead of 1.34%. Moderate earnings for Ternawhich is up by 0.82%.

The strongest sales, on the other hand, show up on Saipemwhich continues trading at -20.50%.

Sales on Unicreditwhich recorded a drop of 6.52%.

Goes down Iveco Groupwith a decline of 4.96%.

Collapses BPERwith a decrease of 4.81%.

Top of the ranking of mid-cap stocks from Milan, Acea (+ 1.26%), Rai Way (+ 0.79%) e BF (+ 0.56%).

The strongest falls, on the other hand, occur on doValuewhich continues the session with -6.00%.

Negative sitting for MPS Bankwhich shows a loss of 5.47%.

Sales hands on Banca Popolare di Sondriowhich suffers a decrease of 5.12%.

Bad performance for Zignago Glasswhich recorded a decline of 4.68%.

Between macroeconomic quantities most important:

Thursday 30/06/2022

01:50 Japan: Industrial production, monthly (expected -0.3%; previous -1.5%)

08:00 Germany: Retail sales, annual (expected -2%; previous -0.4%)

08:00 Germany: Retail sales, monthly (expected 0.5%; previous -5.4%)

08:00 United Kingdom: GDP, quarterly (expected 0.8%; previous 1.3%)

08:45 France: Production prices, monthly (previous 0%).